-

Posted on: 01 Aug 2024

-

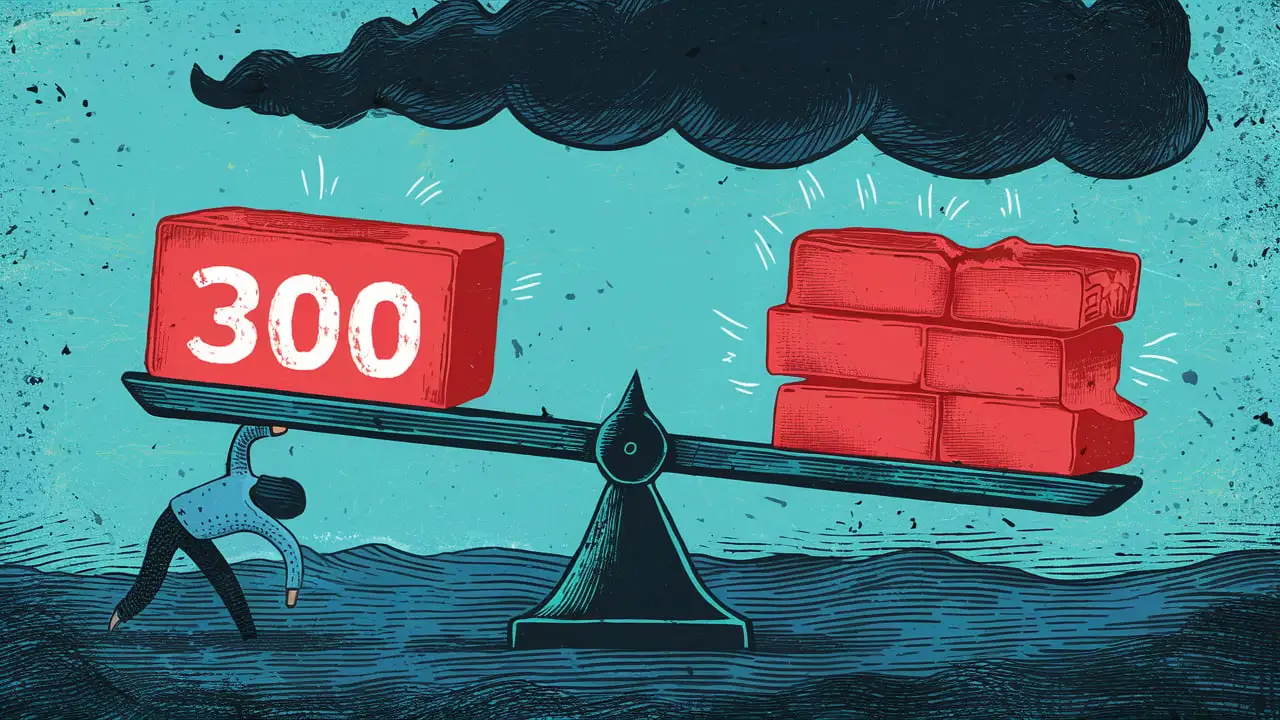

Having a credit score of 300 is regarded as very poor and this will make it almost impossible to be approved for loans, credit cards, mortgages, or any type of credit. Such a credit score means that your credit reports are filled with such things as missed or late payments, collections accounts, bankruptcies, and or other negative items.

A 300 credit score is considered as ‘very poor’ on the FICO credit scoring model which ranges from 300 to 850 which is most commonly used by most creditors. It is close to the lowest possible scores, where any score below 300 is considered to be even worse. This very low score goes a long way to inform lenders that you are a risky customer and potentially may default on your dues.

Effects of having a 300 Credit Score As much as a 300 credit score implies that the holder is incapable of handling credit responsibility and meeting necessary payment deadlines, few companies will grant you new credit facilities. And if you do get approved, it will come with stiff penalties, like: And if you do get approved, it will come with stiff penalties, like:

- Unbelievable interest rates tend to bring the effective cost of debt higher than the nominal cost of money. Personal loans, credit cards, and other forms of borrowing can cost two or three times more to borrowers with very low scores.

- High interest rates mean that credit card holders cannot borrow as much as applicants with better credit scores. This is to ensure that the borrowers do not default on the amounts due and payable and lenders limit the amounts that can be carried forward.

- Higher loan rates are accompanied by large down payments, short loan durations strict loan covenants, and stiff loan schedules. This means that the lenders avoid high loss possibilities in case you fail to meet your obligations.

Specifically, a 300 credit score punishes you for your past poor payment behavior and makes you overpay for credit if you can get it at all.

Why Credit Scores Get So Low Not many individuals have had a perfect record in payment throughout the years. Financial difficulties occur in everyone’s life: unemployment, illness, or other difficulties. However, most credit scores do not go as low as 300 even if there are some missed payments along the way.

Scores fall into the 300s only after a long history of mishandling credit, like: Scores fall into the 300s only after a long history of mishandling credit, like:

- Regularly failing to pay bills on time especially when it comes to credit cards, car loans, and house mortgages. One late payment can begin to decrease your scores even if it has been 30, 60, or 90 days that have passed without any issues. Failing to pay on time is much more damaging in the long run.

- Receiving accounts that are forwarded to debt collectors once you have defaulted in payment. Outstanding balances being sold to collection agencies reduce credit scores greatly.

- Paying off none of the debt obligations at all by not making any more payments once you have defaulted on your payments. Non-performing loans or credit cards ruin your creditworthiness.

- Becoming bankrupt to free oneself from debts. Although bankruptcy provides an opportunity to have a clean slate financially, the records hurt credit scores for years.

- Multiple negative items in the credit report, or having a combination of all these credit report blots at once. You may not get scores of 600 or lower after one or two incidents. However, when it is a repeated incident or a combination, they result in severe complications.

How to Raise a 300 Credit Score The process of fixing a 300 credit score is time-consuming, and requires consistent and accurate work to add positive data to credit reports. There's no quick fix for such substantial damage, but you can start to rebuild trust with lenders using strategies like There's no quick fix for such substantial damage, but you can start to rebuild trust with lenders using strategies like:

- Repayment of all current and open credit accounts without any blemish in the future. Keep the credit active and pay at least the minimum amount due each month on time. Always provide an automatic payment plan whenever it is possible to avoid any situations where payments are missed by default. It also demonstrates that you have repaid your loan obligations on time and in a predictable manner, which makes you a more reliable borrower.

- Reduce balances as much as possible. Lowering the credit utilization shows the creditor that you’re less of a risk and will allow your score to rise steadily. Ideally, try to keep balances below 30% of the credit limit on the credit cards. If possible, pay off installment loans before their due dates.

- You can fix any mistakes on your credit reports by writing a dispute letter to the three credit bureaus. At times, it is brought down by wrong or old data that is included in your credit records. Fix these problems.

- Do not apply for credit that is not necessary for the short-term needs. Each application results in an inquiry, which could further reduce your already low score in the short run. However, incorporating a new account that you occasionally transact and always ensure that it is paid in full every month will help in establishing a creditworthy record. A secured credit card is quite reasonable to begin with as your refundable deposit keeps the small line of credit safe.

- It is recommended that you request the deletion of any evidence of past bankruptcies, settled debts, collections, or charged-off accounts from your credit reports once they have exceeded seven years. These should automatically drop off from your reports. If not, demand that they be deleted.

Getting up from a 300 credit score hole to a better position may take some time depending on the extent of the damage in your credit history. However, gradually and steadily, the credit score can be restored to make them eligible for better rates and credit facilities in the future. This may only mean small improvements month after month in the initial period of training. However, remember that rebuilding credit after consistent late payments requires patience and responsible credit management in the future.

Unlock better loan rates with a higher credit score—dial (888) 803-7889!