Debt may be a great weight on your money and psyche. It makes sense to want to start anew and have the slate spotless. Although there isn't a magic wand to quickly pay off your debt, some techniques can help you greatly lower or even clear it. Approach debt reduction with great thought and knowledge of the possible repercussions.

Knowing Your Debt

It's important to fully evaluate your financial status before starting to explore answers.

List your outstanding debts: List all of your debts—including credit cards, loans, medical bills, and other sources.

Find the overall sum: Find out your overall debt.

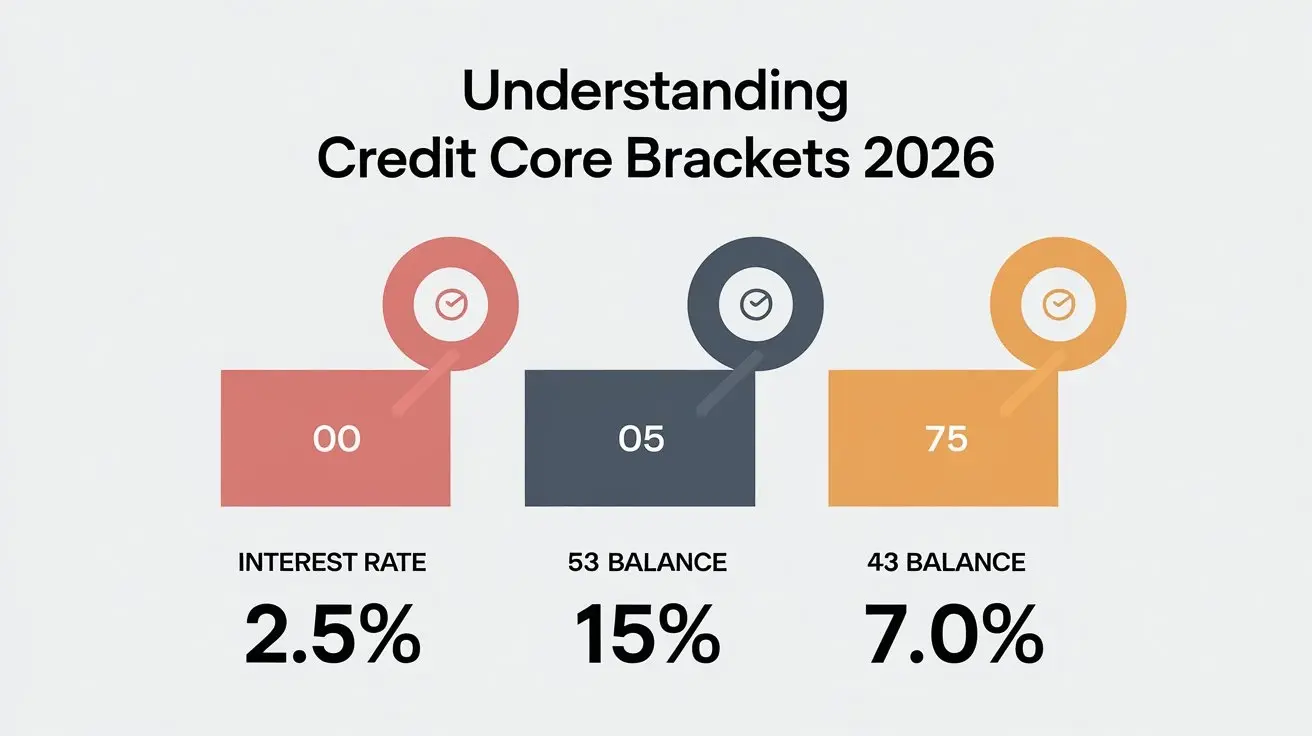

Know the interest rates on every debt you own.

Minimum amounts: Find out each debt's minimum monthly payment.

Income and bills: To find your disposable income, compare your monthly expenses to your income.

Methods of Debt Relief

There are several ways you could address your debt:

1. Consolidation of debt

Combining several loans into one loan with maybe reduced interest rates is what we do.

You ask for a fresh loan to settle your current debt.

Benefits include maybe reduced interest rates and simplified payments.

Drawbacks include the possibility of increasing debt and new loan-related expenses.

2. Debt Management Strategy (DMP)

It is a set debt management strategy developed by a credit counseling company.

You pay the agency one monthly payment, which the agency forwards to your creditors.

Benefits include maybe waived fees, reduced interest rates, and creditor protection.

Drawbacks: effect of credit score; credit counseling service fees.

3. Debt Settlement

Negotiating debt settlement with creditors for less than the total owing is what I do.

How it works: You bargain with debtors to lower your owing balance.

Benefits include maybe greatly lowering debt.

The negative effect on credit scores and the possibility of collecting activities are drawbacks.

4. Bankruptcy: An official legal procedure enabling debt elimination or restructuring for people.

Chapters 7 (liquidation) and 13 (reorganization) comprise types.

Benefits: creditor protection, debt relief.

Drawbacks: major effect on credit score; loss of assets (Chapter 7).

Significant Issues

Many debt reduction programs can have bad effects on your credit score.

Debt relief isn't instantaneous. Act consistently and patiently.

Expert assistance: For direction, think about seeing a bankruptcy attorney or credit counselor.

Financial instruction: Boost your financial awareness to avoid debt downfalls.

Budgeting helps you to prevent future debt by tracking income and expenses.

Create an emergency fund to meet unanticipated expenses.

Use credit cards sensibly and pay off debts right away.

Clearly state your financial objectives and then design a strategy to reach them.

Note: The material offered here is meant for general education and informative only use; it does not offer financial advice. See a professional or financial advisor to evaluate your particular circumstances and investigate appropriate choices.

Recall that controlling your money is a voyage. Debt can be addressed and financial freedom attained with deliberate planning and discipline.

Would you prefer to investigate other debt management issues or concentrate on a certain debt reduction plan?

Call now for expert credit repair services: (888) 803-7889

Read More:

Do charge offs go away after 7 years?

How do I remove a charge-off without paying?

Will Lexington Law improve my credit score?

Did Lexington Law go out of business?

What are negative items in the Lexington Law?