-

Posted on: 01 Aug 2024

-

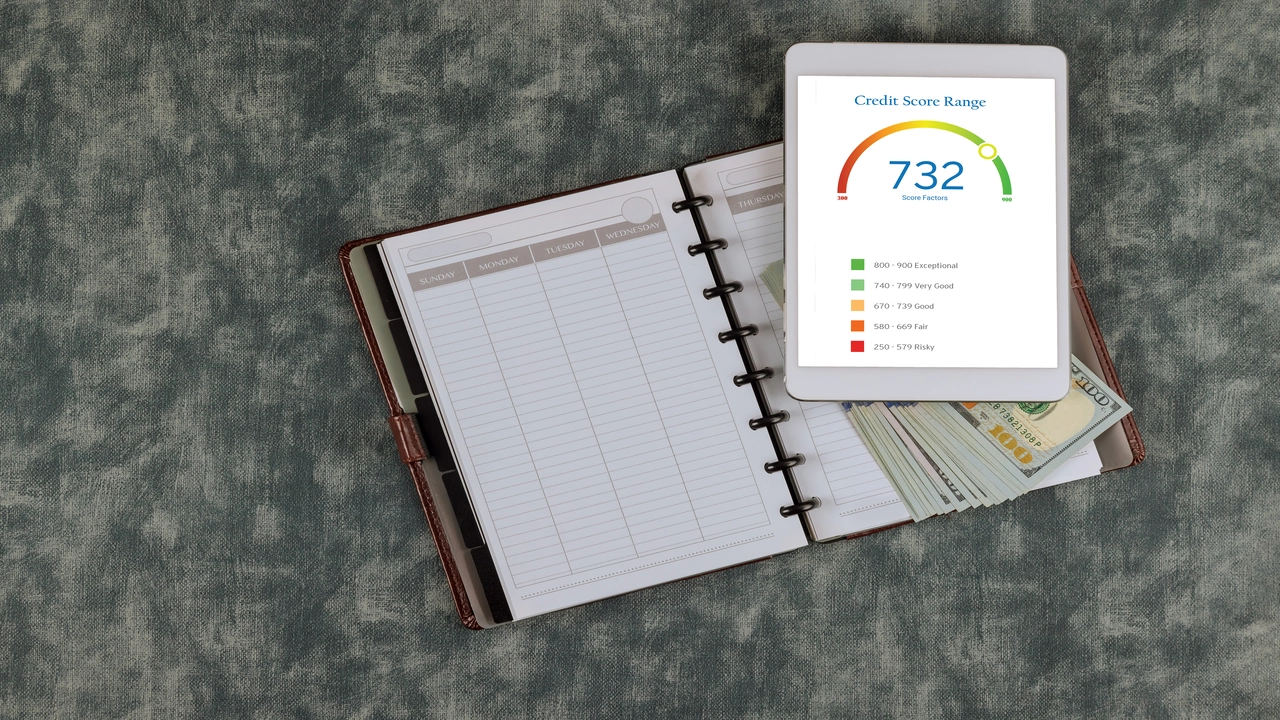

Your credit score is a crucial number that lenders use to determine your creditworthiness. It impacts everything from interest rates on loans and credit cards to your ability to rent an apartment or even get a job. Regularly checking your credit score is essential for maintaining good financial health. But many people worry that simply checking their score will negatively impact it. The good news is that you can monitor your credit score without harming it. This guide will walk you through the different ways to check your credit score without affecting it, explain the difference between soft and hard inquiries, and provide resources for free credit score monitoring.

Understanding Credit Scores and Credit Reports

Before diving into how to check your score, it's important to understand the difference between a credit score and a credit report. They are related but serve different purposes.

- Credit Score: A three-digit number (typically between 300 and 850) that summarizes your creditworthiness. It's based on the information in your credit report and is used by lenders to assess the risk of lending you money.

- Credit Report: A detailed history of your credit activity, including your payment history, outstanding debts, credit limits, and any public records (like bankruptcies).

Your credit score is calculated using the information in your credit report. Therefore, it's essential to check both regularly to ensure accuracy and identify any potential issues.

The Difference Between Soft and Hard Inquiries

The key to checking your credit score without hurting it lies in understanding the difference between soft and hard credit inquiries.

- Hard Inquiry: Occurs when a lender checks your credit report as part of an application for credit, such as a loan, credit card, or mortgage. Hard inquiries can slightly lower your credit score, especially if you have several within a short period of time.

- Soft Inquiry: Occurs when you check your own credit report or when a lender checks your credit report for pre-approved offers. Soft inquiries do not affect your credit score.

Checking your own credit score or report is always considered a soft inquiry. Therefore, you can check your credit score as often as you like without worrying about negatively impacting it.

Methods to Check Your Credit Score Without Affecting It

Here are several legitimate ways to check your credit score without triggering a hard inquiry:

1. Free Credit Score Websites and Apps

Many websites and apps offer free credit scores and credit monitoring services. These services typically provide your VantageScore, which is one type of credit score, based on your credit report data. While VantageScore is not the only credit score model used by lenders (FICO score is also widely used), it can still provide a good indication of your credit health.

Popular Free Credit Score Resources:

- Credit Karma: Provides free credit scores and credit reports from TransUnion and Equifax. It also offers credit monitoring and personalized recommendations for improving your credit score.

- Credit Sesame: Similar to Credit Karma, Credit Sesame offers free credit scores and credit reports, along with credit monitoring and personalized financial advice.

- WalletHub: Offers free credit scores and reports, along with tools for tracking your credit and comparing financial products.

- NerdWallet: While primarily a personal finance website, NerdWallet often provides access to free credit score reports and tools.

These services typically make money through advertising or by recommending financial products. Be aware that they may show you offers for credit cards or loans, but you are not obligated to apply for them.

2. Credit Card Statements

Many credit card issuers now provide free credit scores as a benefit to their cardholders. Check your monthly credit card statement (either paper or online) to see if your issuer offers this service. This is often a FICO score, which is a widely used credit scoring model.

Benefits of Checking Your Score Through Your Credit Card Issuer:

- Convenience: The score is readily available on your existing credit card statement.

- FICO Score: Many issuers provide your FICO score, which is a commonly used score by lenders.

- Credit Monitoring: Some issuers also offer credit monitoring services to alert you to changes in your credit report.

3. Free Annual Credit Reports

You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. You can obtain these reports through AnnualCreditReport.com, the only authorized website for free annual credit reports.

While these reports don't include your credit score directly, they provide a detailed overview of your credit history. Reviewing your credit report is crucial for identifying any errors or inaccuracies that could be negatively impacting your credit score.

Steps to Request Your Free Credit Reports:

- Visit AnnualCreditReport.com.

- Click on the "Request your free credit reports" button.

- Follow the instructions to provide your personal information and verify your identity.

- Choose which credit bureaus you want to request reports from (you can request all three at once or stagger them throughout the year).

- Review your credit reports carefully for any errors or discrepancies.

4. Non-Profit Credit Counseling Agencies

Non-profit credit counseling agencies can provide you with a free credit report review and discuss strategies for improving your credit. These agencies are typically funded by grants or donations and offer unbiased financial advice.

Benefits of Using a Credit Counseling Agency:

- Free Credit Report Review: They can help you understand your credit report and identify areas for improvement.

- Financial Counseling: They can provide personalized financial advice and help you create a budget or debt management plan.

- Debt Management Programs: Some agencies offer debt management programs (DMPs) to help you consolidate your debts and negotiate lower interest rates.

Be sure to choose a reputable non-profit credit counseling agency. You can find a list of accredited agencies on the website of the National Foundation for Credit Counseling (NFCC).

5. Through Lenders (Sometimes)

While generally checking with a lender results in a hard inquiry when applying for credit, some lenders offer features where you can monitor your credit score periodically without impact. This is often tied to existing accounts with the lender. For instance, some personal loan or auto loan providers will give you access to your credit score as part of their online account services.

What to Do After Checking Your Credit Report

Once you've obtained and reviewed your credit report, take the following steps:

1. Dispute Errors

If you find any errors or inaccuracies on your credit report, dispute them with the credit bureau that issued the report. Common errors include incorrect account balances, late payments that were not actually late, or accounts that don't belong to you.

How to Dispute Errors:

- Write a letter: Send a written dispute letter to the credit bureau, explaining the error and providing supporting documentation.

- Online dispute: Most credit bureaus also allow you to dispute errors online through their websites.

The credit bureau is required to investigate your dispute within 30 days. If they find that the information is inaccurate, they must correct it.

2. Improve Your Credit Score

If your credit score is not where you want it to be, there are several steps you can take to improve it:

- Pay your bills on time: Payment history is the most important factor in your credit score.

- Keep your credit utilization low: Credit utilization is the amount of credit you're using compared to your credit limit. Aim to keep it below 30%.

- Don't open too many new credit accounts at once: Opening multiple new accounts in a short period of time can lower your credit score.

- Monitor your credit report regularly: Checking your credit report regularly allows you to identify and correct any errors and track your progress.

3. Be Wary of Credit Repair Scams

Be cautious of companies that promise to "fix" your credit score quickly. These companies often charge high fees for services that you can do yourself, such as disputing errors on your credit report. There is no quick fix for a bad credit score; it takes time and consistent effort to improve your creditworthiness.

Protecting Your Credit

Besides regularly checking your credit score, there are other steps you can take to protect your credit:

- Set up fraud alerts: A fraud alert requires lenders to take extra steps to verify your identity before opening a new account in your name.

- Consider a credit freeze: A credit freeze restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

- Monitor your accounts regularly: Check your bank and credit card statements regularly for any unauthorized transactions.

- Be careful with your personal information: Don't share your Social Security number or other sensitive information with anyone you don't trust.

Conclusion

Checking your credit score regularly is a vital part of maintaining good financial health. By understanding the difference between soft and hard inquiries and utilizing the free resources available, you can monitor your credit score without negatively impacting it. Take advantage of free credit score websites, credit card statements, and free annual credit reports to stay informed about your credit standing and take proactive steps to improve it.