-

Posted on: 25 Jul 2024

-

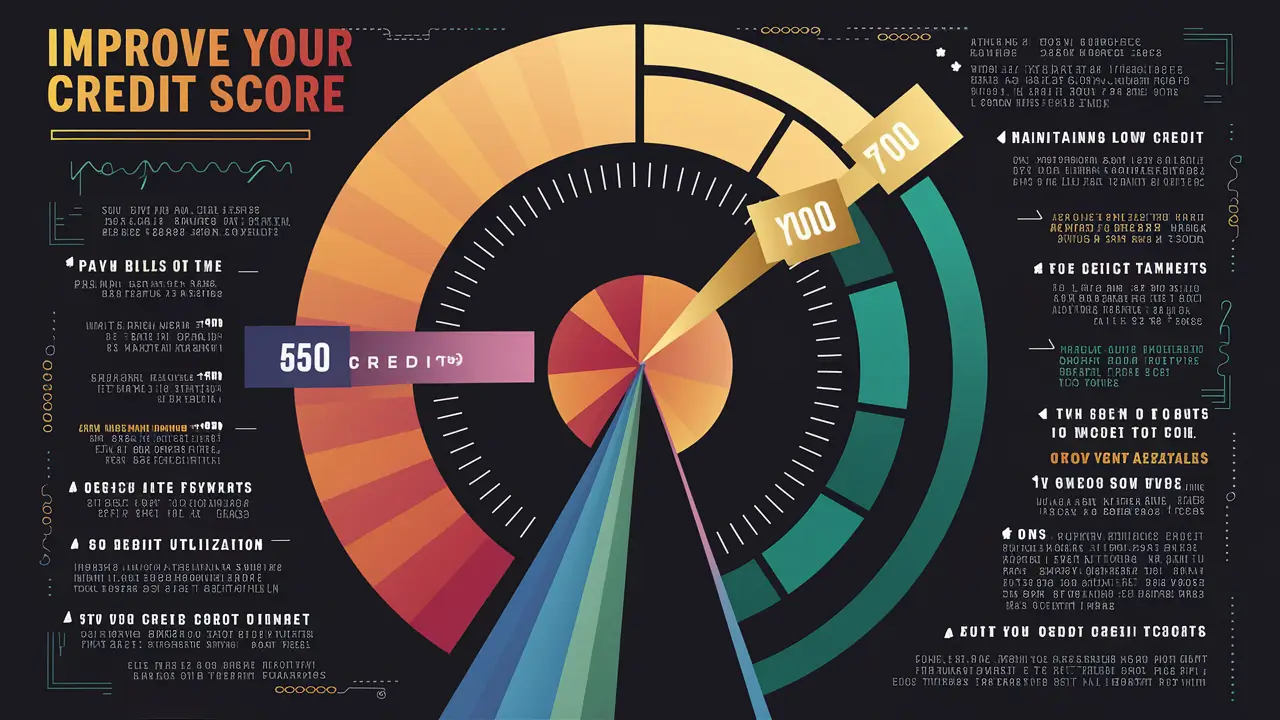

It may take some time and effort to raise the credit score from a fair credit score (650) to a good credit score (700) but it can certainly be done. This is a big advantage because not only does it allow you to qualify for better interest rates and improved loan terms but it also comes in handy when seeking a new dwelling or utility services or a job. And how many lessons is it going to take in the most realistic world to get from 650 to 700? Here’s a look.

Why It Is Important To Increase It by 50 Points Credit score of 650 is considered ‘fair,’ and 700 is considered ‘good’ by FICO standards of rating. It may seem that 50 points is quite a small difference, but passing this mark of 700 and becoming a member of the club of such people who can borrow at much better interest rates and with more favorable conditions from the lenders. A few notable changes occur once one obtains above 700:

- Mortgage rates, car loans, personal, and credit cards, for instance, will be significantly lower – anywhere between $10,000 to $50,000 on major long-term loans.

- You will get to borrow money at prime rate loans and not subprime which has a less stringent approval process. This includes the provision of the best credit cards and attractive rewards and bonus rates as well as attractive and affordable introductory rates.

- You may not need to save for a big downpayment when applying for a loan on a big-ticket item like a home or car to secure the loan or perfect rates.

- Your score will also ensure that you get accepted for rental and employment opportunities more easily. Employers and landlords routinely order credit reports as a part of conducting their background investigation.

You can see that with an increase from 650 to 700, there is a plethora of credit opportunities and loans are cheaper. Sometimes those 50 points could be the deciding factor between staying out of hospital and saving thousands of dollars.

Better Time to Get 50 Points: Realistic Timeframes While it is possible that one could see a raise of 50 points in a month, most financial gurus are inclined to agree with the statement that one could achieve a raise from 650 to 700 within 6-12 months if one would strictly adhere to all the methods of how to improve credit. However, your exact timeframe depends on the existing credit status; it can take a shorter time if the credit status is good.

If you are already following proper credit practices, not using high amounts of your credit card limits, and paying all your bills on time, then it may not take more than 6 months for you to achieve a credit score of 700 or above. Applying for a new credit card account now can also establish a new and healthy payment record in fairly short order, thus raising your credit score.

If the credit behavior is less safe as in high utilization of credit cards or delayed payment, then it might even take 12 months to have a boost of 50 points. This is especially true when you have a record of late payments, or cards that have been maxed out, it will take time before lenders start trusting you again.

It means that with the right strategies, everybody can manage credit properly to meet the qualification for the 700 level in one year. The essence is to remain on track month by month as you continually chip away at the plan. Having patience is also required — credit scores cannot be boosted to a higher level and sustained for the long term in a short time.

Tactics by Which One Can Boost His / Her Credit Score No matter your current score level, using the following credit-enhancing tips can put you on the path to 700 within 6 to 12 months: No matter your current score level, the following credit-enhancing tips can put you on the path to 700 within 6 to 12 months:

Pay All Bills on Time: Credit payment history contributes to 35% of FICO scores. Take daily or weekly calendar reminders for each bill you have and plan for payments to be made automatically where possible. This means that one missed payment for 30 days or even for a day can bring down the score by more than 100 points before it starts rising again.

Keep Balances Low: Do not carry a balance on the credit card above 30% utilization — avoid having balances altogether if you can. Large amounts about your limits constitute about one-third of your credit utilization ratio which is one of the six indicators of a FICO score.

Ask for Credit Limit Increases: The idea is that with a higher limit, one can charge more before crossing a 30% usage threshold. Specifically, you should not wait for issuers to contact you but request them to increase your limits with the frequency of every 6 months of timely payments.

Fix Any Errors on Your Credit Reports: Incorrect information on Equifax, TransUnion, and Experian reports pulls down a true score. Challenge them [the scores] with the particular bureau by writing or through the website.

Open a New Credit Card Strategically: Credit experts recommend having between 3 and 5 cards at any one time with small balances as opposed to having one or having a wallet full of cards. These usually stem from the activation of new cards and therefore one should space the application of new cards every 6 months.

Become an Authorized User: Get someone with good credit to authorize you as a user of a credit card with a long-standing history. Their credit history only changes for the better when included in your reports.

If one puts enough effort and time with concentration to those aspects, anyone can add up from 650 to 700 in less than one year. Check your scores at least once a month to track your progress using a site like AnnualCreditReport.com. com and one of our top picks for credit monitoring, CreditKarma. Keep sticking with the right credit habits and you will soon be enjoying that 700 score.

Call now for expert credit repair services: (888) 803-7889

Read More:

How do you fix badly damaged credit?

What is the National Debt Relief Hardship Program?

How to pay $30,000 debt in one year?

Who qualifies for debt forgiveness?

Are there any legit debt relief programs?