-

Posted on: 05 Aug 2024

-

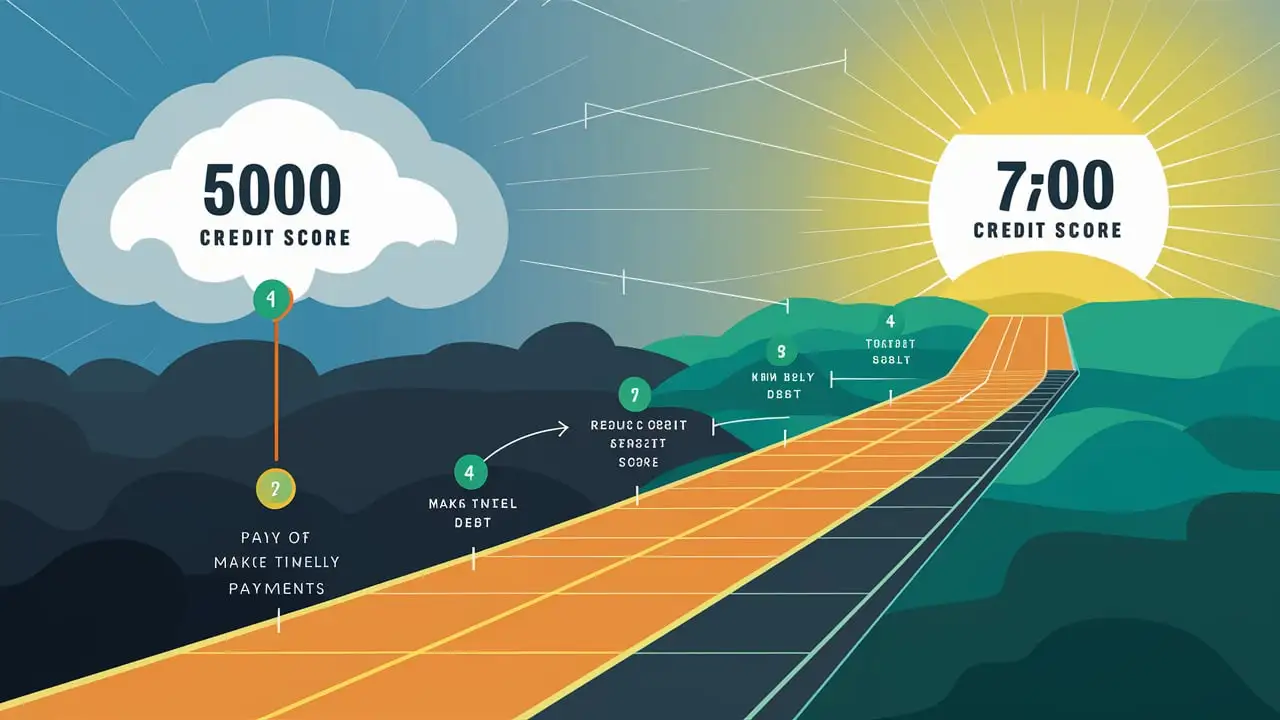

If you now have a credit score below 500, you might feel frustrated and doubt whether you will ever be on the list of those people who have scored more than 700. The great news is that the task of raising a credit score is feasible if one is willing to work and practice good fiscal behavior. In this article, we will consider realistic time frames and possible methods to increase credit score from 500 to 700.

How Long Does It Take?

Should you be actively working to raise your credit score from 500 to 700, it will take one to two years. This is not always the case, however, and depending on your credit history and degree of active rebuilding of your credit, it might take a little less or more time.

The reason it takes so long is credit scores do not change appreciatively over a short time. You have to show that your credit conduct has altered and that it will not be simple to adjust in one month or a few. Steps that help to improve credit over time include paying accounts, keeping modest credit use, having both active revolving and installment accounts, and avoiding mistakes.

Furthermore, if you start implementing excellent habits right now, past poor records will cause your credit score to be low. Depending on the kind of negative marks, including late payments, they may be on the record for up to seven years. Your score will show more improvement even though this takes time to roll off your record as you strive to create a good credit score.

Common Ways to Improve Your Credit

If you want to move from 500 to 700 quickly, focus on a few key areas: If you want to move from 500 to 700 quickly, focus on a few key areas:

Pay Down Balances – The credit card and revolving should not exceed 30% of the credit limit on the respective card. This calls for the repayment of the loan with considerable force in a bid to reduce the balance owed.

Pay Your Bills on Time - Make sure you set up auto-pay or a calendar reminder to make at least the minimum payment on all the accounts without fail and without being late.

Use Limit New Credit Wisely - Do not apply for several credit cards or other lines of credit when rebuilding your credit score; applying for new credit lowers the average credit age which is not good for scores at the beginning.

Check Reports and Dispute Errors – In addition to only checking one credit report regularly, it’s also important to check the other two credit reports and make sure there are no errors that need to be corrected so that the credit report does not depict a wrong picture.

Diversify Credit – It is helpful to diversify credit, having credit cards, auto loans, a mortgage, and the like, to build a better credit mix over time.

Time – This is another factor that you should not lack in the course of doing your work! It takes several years of constant proper financial behavior to establish a good credit score. Just remember to adhere to credit improvement tactics and your climbing score will follow.

But, how fast can this credit score rise?

The time it will take to improve your credit score largely depends on the individual’s effort towards credit repair, but, on average, one should be able to increase their credit score by 50-100 points in about 6 months. But it should be noted that in the initial stages, or when credit is severely impacted, the score may take time before it starts ticking upwards. This is a subjective issue and it can only be determined based on your circumstances.

However, it is realistic to expect that someone could go from 500 to 550, especially if he or she tries to do this within the first 6 to 12 months after enrolling in the class. Then, if positive habits are maintained, the 50-100 point difference at 6 months steps up to get you ‘up to that magic 700 within 1-2 years.

The more good credit steps that you integrate starting today, the closer you will be to credit health and your goals. Betterment is a realistic goal if the right measures are employed to strengthen your fiscal base in the long run. You should also frequently check your scores with your credit report to see how you are faring.

Applying constant effort on a monthly and yearly basis is crucial, so avoid getting frustrated with fluctuations you might experience in terms of scores. Thus, if a person is willing to remain consistent in following the principles of responsible credit management, it is possible to reach a score of 700+ within one or two years.

Reach Your Goals

Whether you are at a dismal level or not, there is always a way to make your credit score way better to help you unlock financial opportunities. The second step, which should take another couple of years, is an intensive credit repair process of working from 500 to 700 Credit Score; it is important to stay motivated in the process as there will be successes and failures along the way.

Through hard work and patience during this credit repair process, a 50-100 point increase every six months will add up to those 700-plus scores that are targeted. By tracking your routine progress assessments that you will be conducting along the way to your goal accomplishment, you will be motivated to get there.

Get fast and reliable credit repair—call (888) 803-7889 to get started!