-

Posted on: 24 Jul 2024

-

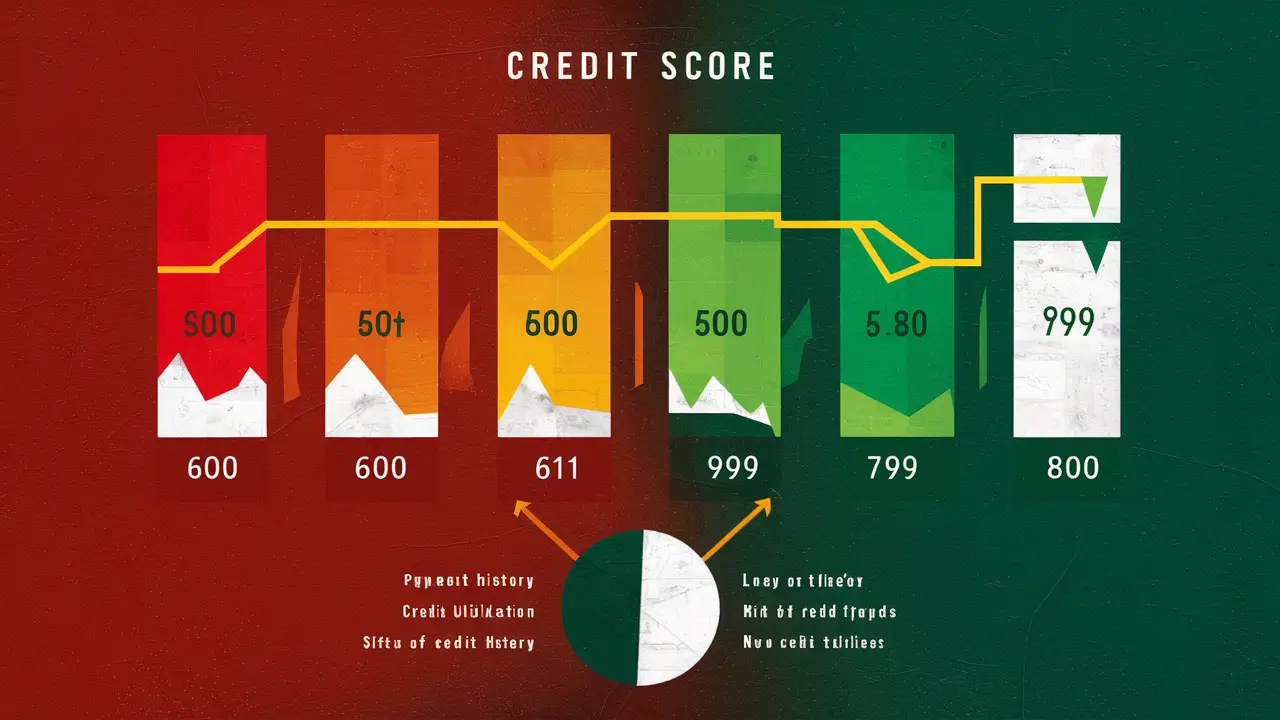

A credit score of 600 puts you in the "fair" range, while an 800 credit score places you firmly in the "excellent" category. This seemingly small difference unlocks a world of financial opportunities, including lower interest rates on loans and credit cards, better insurance premiums, and even easier approvals for rentals and mortgages. While the journey from 600 to 800 might seem daunting, it's absolutely achievable with consistent effort and a strategic approach. This comprehensive guide will provide you with actionable steps and expert tips to propel your credit score upwards.

Understanding Your Credit Score

Before diving into improvement strategies, it's crucial to understand what influences your credit score. The two primary credit scoring models are FICO and VantageScore. While they share similar factors, they may weigh them slightly differently.

Key Factors Affecting Your Credit Score:

- Payment History (35%): This is the most significant factor. Lenders want to see a consistent track record of on-time payments.

- Amounts Owed (30%): This includes your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. High credit utilization can negatively impact your score.

- Length of Credit History (15%): A longer credit history generally demonstrates responsibility and can boost your score.

- Credit Mix (10%): Having a variety of credit accounts (e.g., credit cards, installment loans) can positively influence your score, as long as they are managed responsibly.

- New Credit (10%): Opening multiple new accounts in a short period can lower your score, as it might indicate financial instability. Hard inquiries (when lenders check your credit) also play a role here.

Step-by-Step Guide to Improving Your Credit Score

1. Obtain and Review Your Credit Reports

The first step is to obtain copies of your credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. You can get a free copy of each report annually at AnnualCreditReport.com. Carefully review each report for any errors, inaccuracies, or outdated information. Common errors include incorrect account balances, misreported payment history, or even accounts that don't belong to you.

Why this is important: Errors can significantly lower your credit score. Disputing and correcting them is a crucial step in the improvement process.

2. Dispute Errors on Your Credit Reports

If you find any errors on your credit reports, dispute them directly with the credit bureaus. Each bureau has a process for submitting disputes, typically online or by mail. Provide clear and concise documentation to support your claim. The credit bureau is required to investigate your dispute within 30 days. If the error is verified, it will be removed from your report.

Example Dispute Letter Snippet:

To: [Credit Bureau Name] Subject: Credit Report Dispute Account Number: [Account Number] Date: [Date] I am writing to dispute the following inaccurate information on my credit report: [Describe the error clearly and concisely]. I am enclosing supporting documentation [List documents provided]. I request that you investigate this matter and correct the error on my credit report. Sincerely, [Your Name]3. Make On-Time Payments Consistently

As payment history accounts for 35% of your credit score, making on-time payments is paramount. Set up automatic payments or reminders to ensure you never miss a due date. Even one late payment can negatively impact your score, especially if you already have a lower credit score.

Pro Tip: Consider setting up autopay for at least the minimum payment amount to protect yourself from accidental late payments. If you can afford to pay more, do so to reduce your balance and interest charges.

4. Reduce Your Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you're using compared to your total available credit. Aim to keep your credit utilization below 30% on each credit card and overall. Ideally, strive for a utilization rate below 10% for optimal scoring. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300 (30% utilization) or even better, below $100 (10% utilization).

Strategies to Lower Credit Utilization:

- Pay down your balances: The most direct way to reduce your credit utilization is to pay down your outstanding balances.

- Request a credit limit increase: Increasing your credit limit will lower your utilization ratio, even if your spending remains the same. However, avoid spending more just because you have a higher limit.

- Open a new credit card (strategically): Opening a new credit card can increase your total available credit, thus lowering your utilization ratio. However, be mindful of hard inquiries and avoid opening too many accounts at once. Make sure to use the card responsibly.

5. Avoid Closing Old Credit Cards

Closing old credit cards, especially those with long histories, can negatively impact your credit score. It reduces your overall available credit, which can increase your credit utilization ratio. Unless there is a compelling reason to close a card (e.g., high annual fee), it's generally better to keep it open, even if you don't use it regularly. Consider making a small purchase every few months to keep the account active.

6. Consider Becoming an Authorized User

If you have a friend or family member with a good credit history and a low credit utilization ratio, ask if you can become an authorized user on their credit card. This can help boost your credit score, as the account's payment history and credit utilization will be reported to your credit bureaus under your name. However, make sure the primary cardholder is responsible, as any negative activity on the account will also affect your credit score.

7. Diversify Your Credit Mix (Carefully)

Having a mix of credit accounts (e.g., credit cards, installment loans) can positively impact your credit score. However, don't take out loans you don't need just to improve your credit mix. Focus on responsibly managing the credit accounts you already have. A secured credit card or a credit-builder loan can be good options if you need to establish or rebuild credit.

8. Be Patient and Consistent

Improving your credit score takes time and consistency. It's not a quick fix. Continue to practice good credit habits, such as making on-time payments and keeping your credit utilization low, and you will gradually see your score improve. Check your credit reports regularly to monitor your progress and identify any potential issues.

9. Credit-Builder Loans

Credit-builder loans are specifically designed to help individuals with little or no credit history, or those with damaged credit, improve their credit scores. These loans typically work by you making payments into a secured account, and after the loan term, you receive the funds back (minus interest and fees). The regular payments are reported to the credit bureaus, helping to establish a positive payment history.

10. Secured Credit Cards

Secured credit cards are another good option for those with limited or damaged credit. You provide a security deposit, which typically serves as your credit limit. Using the card responsibly and making on-time payments helps build credit. After a period of responsible use, some secured cards may be converted into unsecured cards, and your security deposit will be returned.

11. Avoid Credit Repair Companies (Generally)

While credit repair companies promise to "fix" your credit, they often make unrealistic promises and charge hefty fees. Most of what they do, you can do yourself for free. Focus on disputing errors yourself and practicing good credit habits. Be wary of companies that guarantee specific results or pressure you to pay upfront fees.

12. Understand How Different Credit Scores Work (FICO vs. VantageScore)

While both FICO and VantageScore aim to predict your creditworthiness, they use slightly different algorithms and data. Lenders tend to use FICO more often when making lending decisions, but knowing both helps you understand your overall credit standing. For example, VantageScore might place less emphasis on older, inactive accounts than FICO.

13. Limit Hard Inquiries

Each time you apply for credit, a lender will make a "hard inquiry" into your credit report. Too many hard inquiries in a short period can lower your credit score. Only apply for credit when you genuinely need it.

14. Track Your Progress

Regularly monitor your credit score and credit reports to track your progress and identify any new issues that may arise. Most credit card companies and banks offer free credit score monitoring services. Use these tools to stay informed and make adjustments to your credit-building strategies as needed.

How Long Will It Take to Go From 600 to 800?

The time it takes to go from a credit score of 600 to 800 varies greatly depending on individual circumstances, including the specific factors that are currently impacting your score, your credit history, and your commitment to practicing good credit habits. It could take anywhere from several months to several years. Consistency and diligence are key to achieving your goal.