-

Posted on: 08 Feb 2025

-

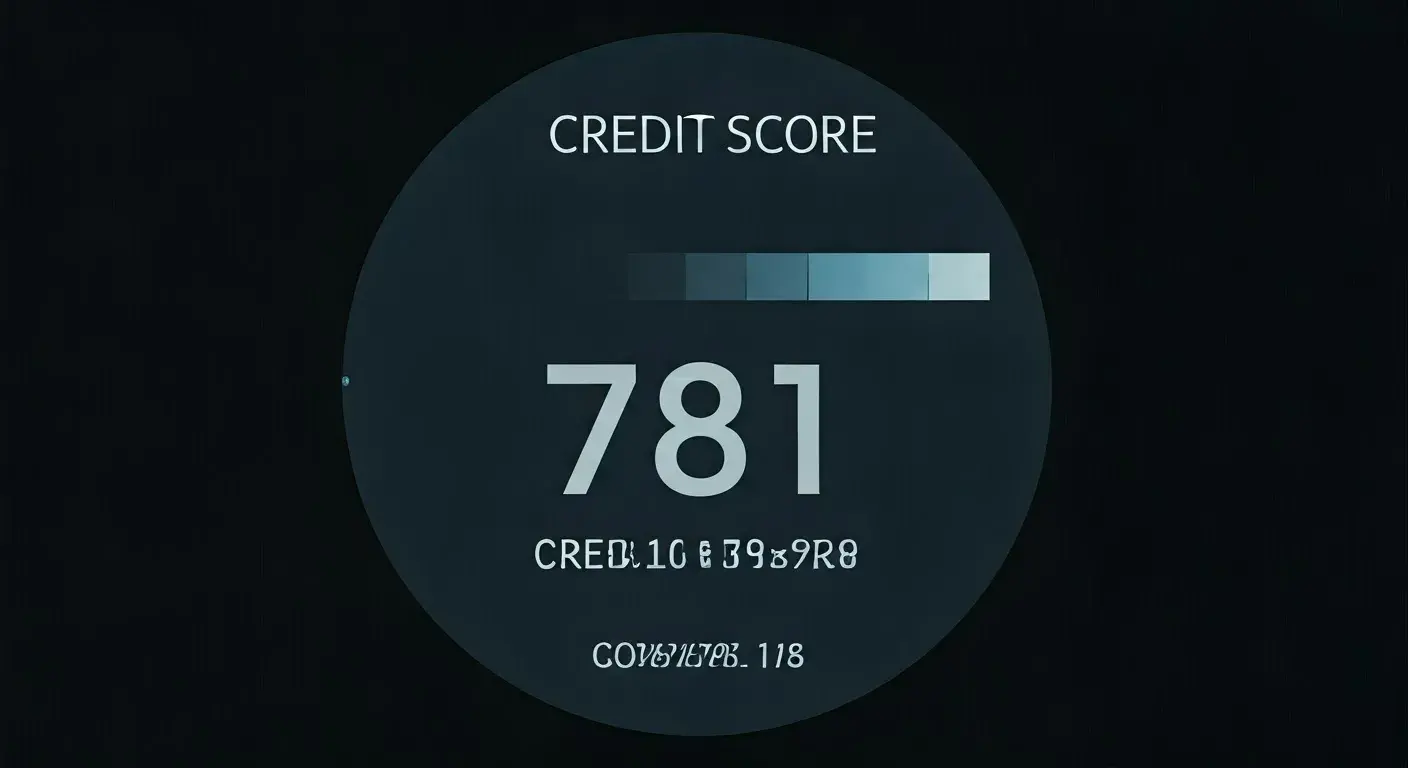

Your credit score is a number that shows how good you are at managing money. A good credit score, such as 781, can change the way you deal with money. It can help you get loans and lower interest rates. This guide will explain what a 781 credit score means and the benefits it brings. It will also give you practical tips to keep your credit in good shape and help it get even better.

Understanding the Value of a 781 Credit Score

A credit score of 781 puts you in the "excellent" category. This means you can get better lending terms, higher credit limits, and more types of financial products. A score of 781 shows lenders that you are low risk when it comes to paying back money.

Having this excellent credit score shows that you handle your money well. It can help you when you apply for loans, credit cards, or even when you rent an apartment. The higher your score is, the better your chances are of getting approved and getting the most competitive terms.

How a 781 Score Fits Within Credit Rating Scales

Credit scores come from models made by companies like FICO and VantageScore. Even though they use different methods, they usually have similar ways of classifying credit ranges.

A FICO score of 781 is in the "Very Good" range, which is from 740 to 799. On the other hand, a VantageScore of 781 is in the "Excellent" range, from 781 to 850. These scores look at factors such as your payment history, credit utilization, credit mix, how long you have had credit, and recent credit checks. Having a balanced credit profile across these factors can lead to a great score.

Experian, a top credit reporting agency, says a score of 781 can help you get various financial products with good terms. This score shows that you manage your credit well.

The Impact of a 781 Score on Financial Opportunities

A 781 credit score can greatly change your financial situation. Lenders see people with excellent credit as low risk. Because of this, they tend to offer loans and credit at better terms.

Here’s how this score can affect different financial areas:

-

Available Credit: With a high credit score, you often get larger credit limits on credit cards and higher loan amounts from lenders.

-

Financial Products: You can access more financial products, like top credit cards that come with special rewards and benefits.

-

Lower Interest Rates: A 781 score usually means you qualify for the best interest rates on loans. This can save you a lot of money over the years.

Benefits of Having a 781 Credit Score

A 781 credit score looks great on your credit report. It also brings real benefits that can help your financial life. With a high credit score like yours, you can get lower interest rates and have more choices in financial products.

When you see these benefits, you will feel inspired to keep up this strong score. It will help you make smart financial choices.

Competitive Interest Rates and Terms

One of the best things about a 781 credit score is that you can get good interest rates and loan terms. If you want an auto loan, a mortgage, or a personal loan, your great credit score will help you.

Lower interest rates mean you will pay less each month. This will save you money over the life of the loan. For example, a small change in the interest rate on a mortgage could save you thousands of dollars over 30 years.

Your credit score also affects interest rates on credit cards. With a great score, you usually qualify for credit products that have lower APRs. This lowers the cost of borrowing and helps you handle your credit card debt better.

Increased Approval Odds for Loans and Credit Cards

Having a credit score of 781 boosts your chances of getting approved for loans and credit cards. Credit card issuers and lenders see this score as a sign that you manage money well. This increases your chances of getting the credit you want.

A 781 score can lead to:

-

Higher approval rates for new credit card applications. This helps you create a varied credit portfolio and enjoy different rewards programs.

-

Better credit card offers great benefits meant for people with excellent credit.

-

More access to lines of credit for personal or business needs, which gives you more options and financial safety.

Navigating Credit Options with a 781 Score

With a great credit score of 781, you have many choices for credit options. Lenders and credit card issuers want your business.

However, it's important to think carefully about these options. Let's look at how to pick the best credit products and get the best terms that fit your financial goals.

Choosing the Right Credit Cards

Your 781 credit score gives you access to many credit card choices. You can pick from travel rewards cards or cashback cards. Find the best card that matches how you spend and what you want to achieve financially.

To make the most of your excellent credit:

-

Compare rewards programs: Look into different credit cards that offer cashback, travel points, or other rewards that fit your lifestyle.

-

Consider annual fees: Some top credit cards have good rewards but charge annual fees. Check if the rewards are worth the fees based on how you spend.

-

Prioritize responsible credit card use: Take care of your credit card debt. Always pay your balance in full and on time to keep your excellent score. One common choice for balanced rewards and good credit management is the Chase Freedom Unlimited® card.

Securing Auto Loans and Mortgages

When it comes to securing auto loans or mortgages, your 781 credit score becomes a valuable asset. Lenders are more willing to offer those with excellent credit the lowest interest rates, saving significant money over the loan's lifetime.

Here's a comparison of how your credit score might influence your mortgage interest rates:

Negotiating car loan terms is also more favourable with a 781 score. You can secure lower monthly payments, a shorter loan term, or even a lower down payment, making your dream car more affordable. Remember to shop around and compare rates from various lenders to ensure you secure the most competitive terms.

Strategies to Maintain and Enhance Your 781 Score

Getting an excellent credit score is something to be proud of. However, keeping it high and making it better takes work over time. Your credit score changes based on how you handle your money. So, it's important to use good credit habits.

You can protect your 781 credit score and even improve it by adding easy and smart tips to your money routine.

Key Habits for Credit Health

Maintaining a good credit score means you need to follow some helpful habits. These habits show that you can manage money well, and credit agencies:

-

Manage Credit Utilization: It's important to keep your credit utilization low. Aim for below 30% of your total credit. This means you should use less of what you can spend. Paying off what you owe helps raise your score because you use less of your available credit.

-

Prioritize On-Time Payments: Late payments can hurt your credit score a lot. Your payment history is very important in calculating your score. Set up reminders for when bills are due. You can also use automatic payments to help avoid missing any payments. Just one late payment can lower your score.

-

Build a Long Credit History: The longer you have credit, the better your score can be. Keep your oldest credit accounts open and in good shape. This will help raise your credit age and improve your overall score.

Monitoring and Correcting Credit Reports

Regularly checking your credit reports is very important for keeping your credit healthy. You can get a free credit score from each of the three main credit agencies—Equifax, Experian, and TransUnion—once a year through different online sites.

Look at your reports closely for any mistakes. If you find any wrong information, dispute it with the credit bureau. Sometimes, these reports have errors that, if not fixed, could lower your score.

By staying updated and taking action, you can find problems early and make sure your credit report shows your good financial behaviour.

Conclusion

A 781 credit score is more than just a number. It opens the door to better financial chances. You can get lower interest rates and have a better chance of being approved for loans. Managing your credit can be easier, too. This includes choosing the right credit cards and getting loans or mortgages.

You can keep your score high by using good habits for your credit health. It's important to check your credit reports regularly. A 781 score is valuable. Knowing how it fits into the credit rating scale can help you make the most of it. By managing your finances well, you can use your score to access better credit offers and lower mortgage rates. Stay updated and proactive, and you will see your financial future improve.

Raise your credit score effortlessly—dial (888) 803-7889 for professional help!

-