-

Posted on: 27 Jan 2025

-

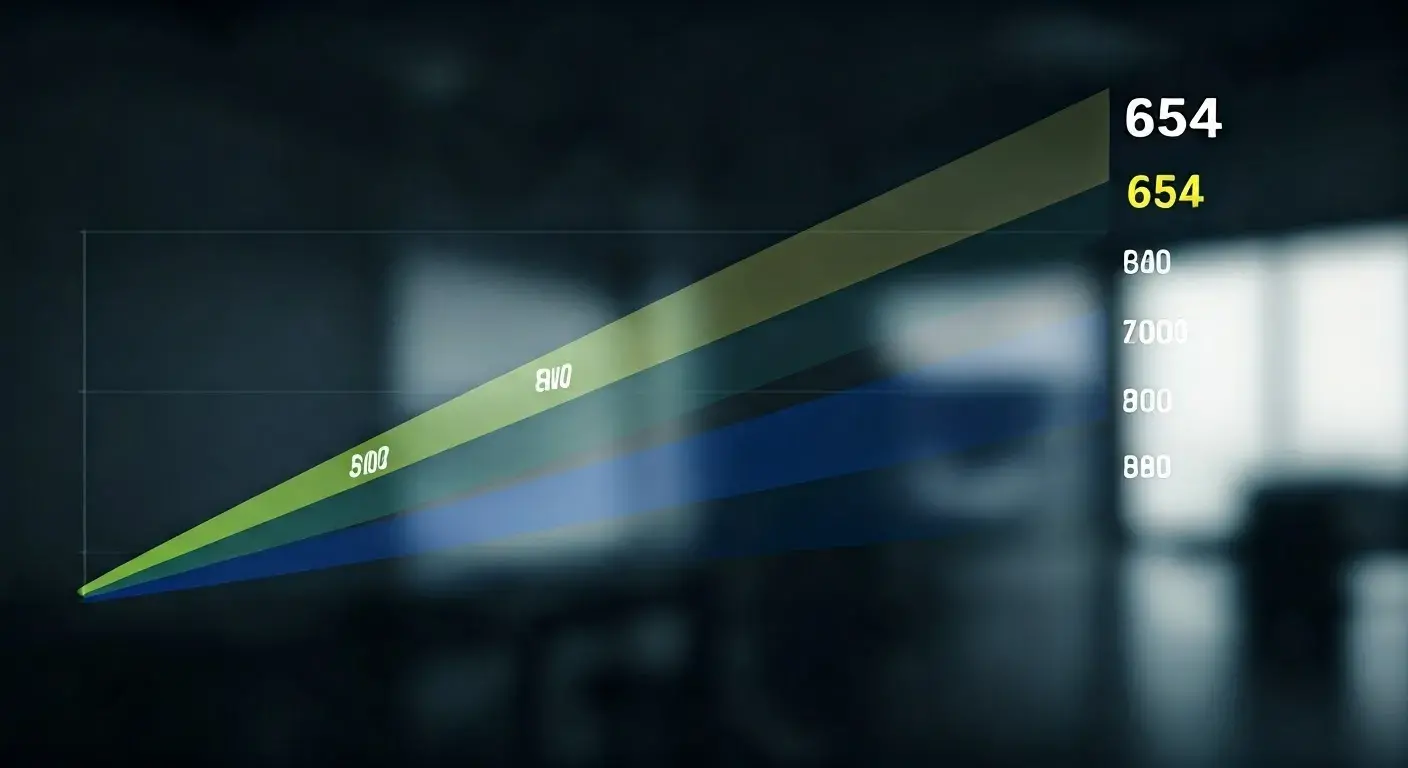

Your credit score is a three-digit number that plays a significant role in your financial life. It's a key factor lenders use to assess your creditworthiness and determine whether to approve you for loans, credit cards, and other financial products. A higher credit score typically leads to better interest rates and terms, while a lower score can result in higher costs or even denial of credit. So, where does a 654 credit score fall on the spectrum, and what does it mean for your financial future? Let's dive into the details and uncover the truth.

Understanding Credit Score Ranges

Before we evaluate a 654 credit score, it's essential to understand the standard credit score ranges used by the two major credit scoring models: FICO and VantageScore. While there might be slight variations between lenders and credit bureaus, the following ranges generally apply:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Based on these ranges, a credit score of 654 falls into the Fair category. While it's not a bad score, it's not considered good either. It indicates that you have some credit history but may have encountered some challenges along the way.

What Does a 654 Credit Score Mean for You?

Having a fair credit score like 654 can present both opportunities and limitations when it comes to accessing credit and other financial products. Let's explore the potential implications:

Loan Approval

Getting approved for loans with a 654 credit score is possible, but it might not be as straightforward as with a higher score. You may face higher interest rates and less favorable loan terms. For example, when applying for a mortgage or auto loan, a 654 credit score could result in a higher annual percentage rate (APR), increasing your overall borrowing costs.

Credit Card Approval

You'll likely be approved for some credit cards, but the selection of cards available to you might be limited. You may not qualify for premium cards with attractive rewards and perks. Instead, you'll probably be offered secured credit cards or cards designed for individuals with fair credit. These cards often have higher interest rates and lower credit limits.

Interest Rates

One of the most significant impacts of a 654 credit score is the interest rates you'll receive on loans and credit cards. Lenders view individuals with fair credit as higher-risk borrowers and compensate for that risk by charging higher interest rates. This means you'll pay more in interest over the life of the loan or credit card, ultimately costing you more money.

Insurance Premiums

In some states, insurance companies use credit scores to determine insurance premiums. A lower credit score, like 654, could result in higher premiums for auto insurance or homeowners insurance. This is because insurance companies believe that individuals with lower credit scores are more likely to file claims.

Rental Applications

Landlords often check credit scores as part of the rental application process. A 654 credit score might not automatically disqualify you from renting an apartment, but it could make it more difficult. Landlords may require a higher security deposit or ask for a co-signer to mitigate the risk.

Employment Opportunities

Some employers, particularly in the financial industry or positions that require handling sensitive information, may check credit scores as part of the background check process. While a 654 credit score is unlikely to prevent you from getting a job, it could raise concerns if there are other negative factors in your background.

Factors That Influence Your Credit Score

Understanding the factors that influence your credit score is crucial for improving it. The five main factors used in FICO score calculations are:

- Payment History (35%): This is the most important factor. It reflects whether you've made your payments on time consistently. Late payments, even by a few days, can negatively impact your credit score.

- Amounts Owed (30%): This refers to the amount of debt you owe relative to your credit limits. It's often referred to as credit utilization. Keeping your credit utilization below 30% is generally recommended.

- Length of Credit History (15%): This considers how long you've had credit accounts open. A longer credit history typically leads to a higher credit score.

- Credit Mix (10%): This refers to the variety of credit accounts you have, such as credit cards, installment loans, and mortgages. Having a healthy mix of credit accounts can positively impact your score.

- New Credit (10%): This reflects how often you've applied for new credit accounts recently. Opening too many new accounts in a short period can lower your score.

Strategies to Improve a 654 Credit Score

Improving your credit score takes time and effort, but it's achievable with the right strategies. Here are some actionable steps you can take to boost your credit score from 654:

Pay Bills On Time, Every Time

This is the most critical step. Set up automatic payments or reminders to ensure you never miss a payment. Even one late payment can significantly damage your credit score.

Reduce Credit Card Balances

Aim to keep your credit card balances below 30% of your credit limits. Ideally, you should strive for even lower utilization, such as below 10%. Pay down your balances as quickly as possible to improve your credit utilization ratio.

Avoid Opening Too Many New Credit Accounts

Opening multiple new credit accounts in a short period can lower your score. Only apply for new credit when you genuinely need it.

Monitor Your Credit Report Regularly

Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) regularly to identify any errors or inaccuracies. Dispute any errors you find to have them corrected.

Become an Authorized User

If you have a trusted friend or family member with a credit card and a good credit history, ask if you can become an authorized user on their account. Their positive payment history can help improve your own credit score.

Consider a Secured Credit Card

If you're having difficulty getting approved for a traditional credit card, consider a secured credit card. These cards require a security deposit, which typically serves as your credit limit. Using a secured credit card responsibly can help you build or rebuild your credit.

Explore a Credit Builder Loan

A credit builder loan is a small loan designed to help you establish or improve your credit. The funds are typically held in a savings account, and you make regular payments on the loan. Once you've repaid the loan, you receive the funds, and your credit score benefits from the positive payment history.

The Timeline for Credit Score Improvement

The time it takes to improve your credit score depends on several factors, including the severity of your credit issues and the steps you take to address them. It can take several months to see significant improvements, especially if you have a history of late payments or high credit card balances. Consistency and patience are key.

Keep in mind that credit scores are dynamic and constantly changing based on your credit activity. By adopting good credit habits and consistently managing your finances responsibly, you can steadily improve your credit score over time and unlock better financial opportunities.

Maintaining a Good Credit Score

Once you've improved your credit score, it's essential to maintain those good habits to keep your score high. This means continuing to pay your bills on time, keeping your credit card balances low, and monitoring your credit report regularly. A good credit score is a valuable asset that can benefit you in many ways throughout your life.

Conclusion: 654 Is A Starting Point, Not A Destination

In conclusion, while a 654 credit score is considered fair, it's not ideal. It can impact your ability to access credit, secure favorable interest rates, and even influence other areas of your life, such as insurance premiums and rental applications. However, it's important to remember that your credit score is not set in stone. By understanding the factors that influence your credit score and implementing the strategies outlined above, you can improve your credit and unlock better financial opportunities. Consider 654 as a starting point and commit to building a brighter financial future!