Applying and getting a $250,000 mortgage is an important and significant step in anyone’s financial life – and the decision should not be taken lightly. Another area that the lenders will consider when evaluating your mortgage application is your credit score. Then, what credit score is required to obtain a mortgage credit of $250,000?

What Credit Score Most Lenders Consider

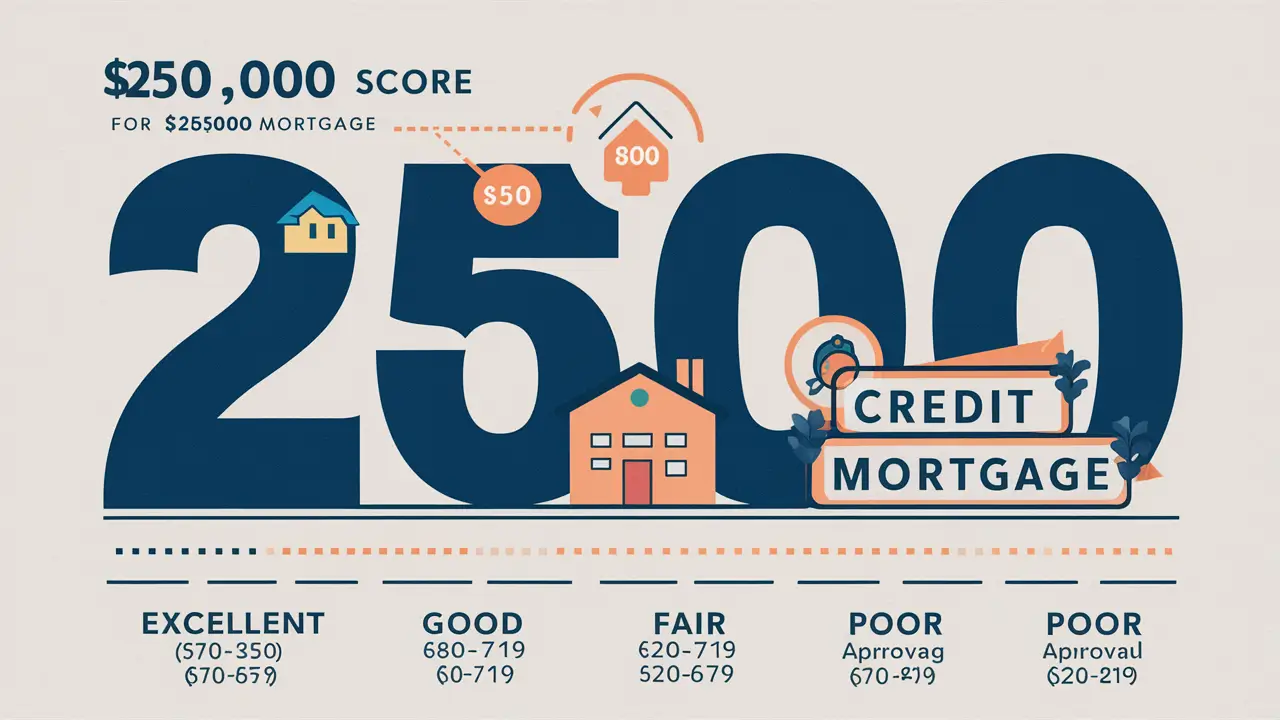

Today, most lenders require a credit score of 620-640 as a bare minimum to qualify for a $250,000 conventional loan. But if you are looking to lock in the best interest rates possible, your credit score has to be above 740. Here’s an overview of typical credit requirements:Here’s an overview of typical credit requirements:

- 620-639: A down payment of 3.5% is possible if one qualifies for an FHA loan.

- 640-679: Can be approved for some standard loan products and get relatively low interest rates

- 680-719: Meets most standard variable rate mortgages.

- 720+: Good credit that is good enough to afford the lowest rates on the scale.

- 760+: Prime mortgage & rate for top tier credit eligible

The credit score is directly proportional to the chances of getting approved and inversely proportional to the interest rate. To obtain a good rate quote on a $250k mortgage, it is advisable to strive to get a minimum of 720.

How Lenders Analyze Your Credit Report

Lender will look at your credit in detail when you apply for a mortgage and it goes beyond looking at your score. They desire to observe sound credit that reflects moderation in the use of lending responsibilities. Key factors include:

- Any credit payment history of debt accounts such as credit cards and auto loans

- Outstanding balances of credit card and other revolving credit.

- Length of credit history and the types of credit used

- Inquiries that have taken place within the last 30 days and have affected your credit score

It is important to remember that the content of the credit report and what it has to say about income, assets, and credit capacity are just as crucial as the credit score. Therefore, in addition to the minimum score, buyers should scrutinize their credit reports and clean up on any items that might provoke problems during approval.

How to Manage Your Credit to Get a Better Credit Score

If your credit score isn’t quite high enough to get approved or score the lowest rates, some things you can do to improve it include:

1. Reduce revolving credit balances such as credit card balances

2. Pay off any of the payments that were made at a later time than agreed and consider the option of using automated systems.

3. Avoid applying for more credit than necessary since this is likely to lower your credit score.

4. List credit reporting errors or old issues to be deleted from the credit reports

5. Keep on paying existing credit accounts and other monthly expenses in a responsible manner.

It is also important that the borrower keep a close eye on their credit score in the run up to the completion of the mortgage application form. It will take at least six months to improve the low credit score and show the proper past behavior to creditors. This can greatly improve the chances of mortgage loan approvals and also the interest rates.

Getting Advice from a Good Loan Officer

The whole procedure of mortgage approval might appear rather daunting and challenging to understand, especially when it comes to deciding on the sort of credit score that will enable you to avail the mortgage of your choice. The advice of an experienced loan officer or a mortgage broker can be of great help. They can:

- Please check credit reports, income and assets to give an opinion on the chances of approval.

- Provide detailed recommendations on what you can do in your particular case to enhance your mortgage eligibility.

- Shop multiple lenders to find competitive loan programs that suit your credit strength and financial profile.

- If credit or qualification issues exist for underwriters, this will try to negotiate on your behalf.

To sum up, one needs a score of at least 620-640 to possibly get approved for a $250K mortgage, while having a score of 720+ will not only guarantee approval, but also the lowest interest rates, which saves tens of thousands throughout the term of the loan. Speaking to mortgage and credit experts some time before when you will need financing will therefore be useful in the attainment of this goal.

Call now for expert credit repair services: (888) 803-7889

Read More:

How much of a home loan can I get with a 650-credit score?

How rare is an 820-credit score?

Can I buy a house with 717 credit score?

How common is a 900-credit score?