-

Posted on: 06 Aug 2024

-

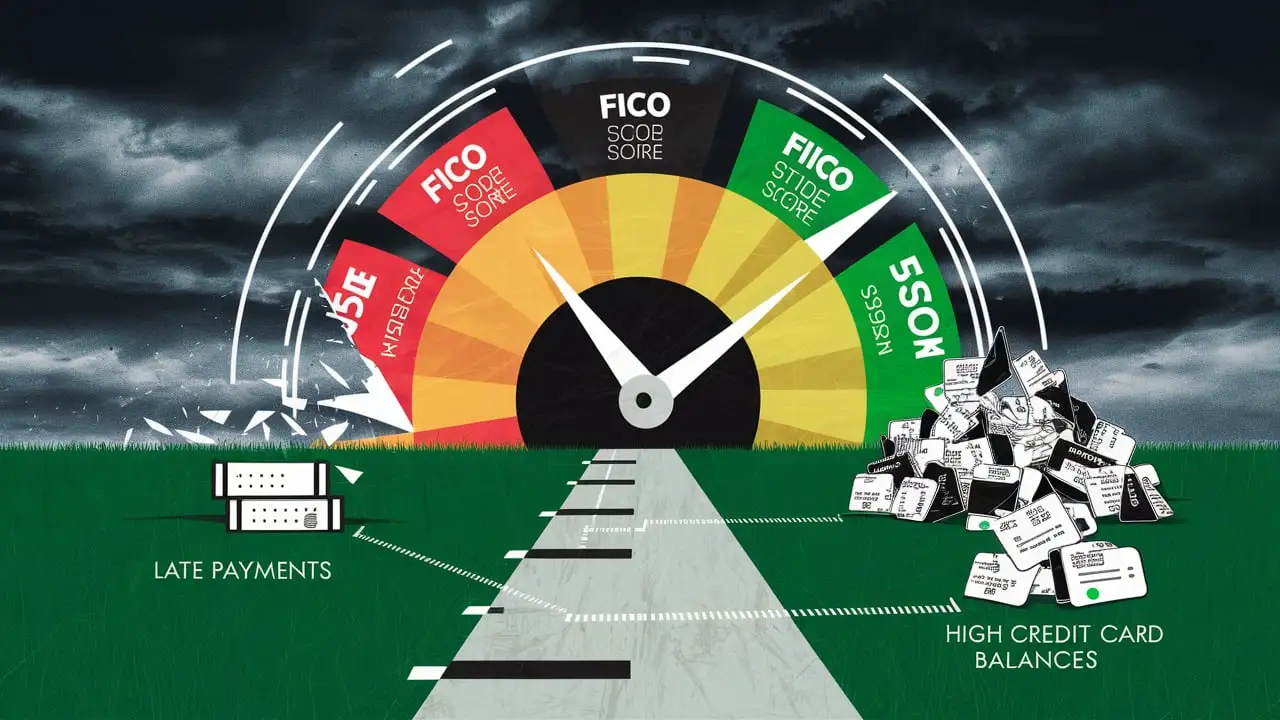

Your FICO score is one of the numbers that matter most in your financial life. The FICO score is widely used by lenders and creditors to assess the credit risk of borrowers for extending credit cards, auto loans, mortgages, and other forms of credit. However, several things can lead to a decline in your FICO score, as mentioned below. It is therefore important to always be aware of them and avoid using them as often as possible if one wants to maintain a good credit score.

1 Late payments: This is one of the most effective means of reducing the FICO score, and this happens when an individual misses a payment on any credit accounts that they have. This aspect contributes to the majority of the credit score, and any delayed payment will reflect on your credit report and consequently lower the score. Sometimes, they are only a few days behind, and it can massively decline. If you don’t make any payments at all and become delinquent, then the impact on your score will be even higher.

2. Most credit applications – The usage of most of your available credit, reflected in your credit card’s credit limits, drastically lowers your score. It is wise to ensure that the credit utilization on every card and the overall credit utilization is below 30%. Your score will drop as you approach the limit on any card you have in your possession. Having cards at their limits is particularly bad.

3. Making too many inquiries within a short period – Applying for and getting many credit cards or some other form of credit within a short time will show risk to lenders. Accumulating that much new potential debt in one bunch does not instill confidence that you can handle more credit responsibly. Each credit application also leads to a hard credit check, which in turn can cost you a few points in your credit score. If you are not experiencing a situation that requires you to open many accounts within the same period, do not open many accounts within a short period.

4. Closing old credit card accounts - Sometimes, one might feel that closing credit card accounts you no longer use is a smart thing to do to make your credit report clean; this is not right, as it can harm you. Closing accounts reduces the total credit limit you have, which in turn, pushes up your credit utilization rate. It also reduces the average age of your open accounts, which are other factors that FICO takes into consideration. Do not close existing accounts, but rather keep them active. Inactive credit cards are also good for your score if they show a good payment history and improve your credit limit.

5. Using credit kinds that do not establish credit history – Not all credit forms are the same in terms of credit. Car loans, personal loans, mortgages, student loans, credit cards, and most auto loans can be said to be useful to credit profiles, as payments made on time are reported to credit bureaus. However, accounts like medical bills, phone plans, rent, and utility bills do not contribute to credit-building. However, failure to make payment on those accounts or having them turned over to collections can severely impact your score.

6. Failure to dispute credit report entries - Mistakes can appear on any credit report at any time by way of technical slip-ups, partially filled accounts, fraud, and even identity theft. However, if there are wrong, old, or unconfirmed negative items on your credit report, report them to the credit bureaus. Otherwise, they will keep pulling down your score, plus lenders will proceed to make decisions based on all the information provided. Always remain alert and glance through your reports frequently.

7. Frequent application for credit – FICO considers individuals who apply for several credit facilities within a short period as being credit risky. This is because some creditors suspect that such consumers are almost reaching their financial limits to borrow and are likely to take risky credit. As highlighted before, the third way that credit inquiries affect your score is that they slightly. Use new credit cautiously and do not apply for new credit just because you receive offers.

8. Frequent use of credit limit – Most consumers do not know that excessive utilization of the amount of credit you are allowed puts your credit score at risk. Paying credit card balances in full helps, but maxing out cards and then paying them off again as a strategy negatively impacts credit utilization. Also, it can let us know about the potential expenditure. To have the best credit mix, ensure that you only utilize a small portion of your total credit limits each month.

9. No credit history - Length of credit history contributes to about fifteen percent of the FICO score computation. That is undesirable if you are a first-time credit user or if you have a few accounts open. As a rule, to establish a good credit score, one must have at least three or four active credit accounts with the credit line in operation for more than one year. However, be careful when creating several new accounts within a short time to speed up history, because it can lead to negative results.

-

Paying bills after the due date frequently, even if it is a small amount, Payment history is the most critical aspect of your credit score since it contributes approximately one-third of the total tally. That means any late payment is heavily against you, regardless of the time difference. Occasional 30, 60, and 90-day delays can offset years of punctual payments. Try not to ever be late paying on any of your credit accounts if you can help it.

- Allowing accounts to reach collections – If, for any reason, you end up being in arrears on any of your accounts and do not deal with the past due status before charge off, they will go to collection agencies. At that point, your FICO score will drop significantly lower than it is now. Collections raise very credible doubts about your capability and desire to pay your debts. Do not have charge-offs and make accounts current before they reach this level. And then paying collections will not even help your credit report much either. The initial late payments and collection markings on your report will also go on to decrease your score for years.

In conclusion, to enhance the protection of the FICO score one needs to pay attention to the credit details to have it checked regularly; high balances on accounts must be avoided; credit lines that have been opened for a long duration must not be closed; mistakes that appear on credit reports must be rectified as soon as possible; and lastly, the accounts that are available to one should not be missed at any time. One or two mistakes would not have a lasting impact on the credit score, but consistent problems such as missed payments, high balances, and collections would ruin the score. Do not practice these unhealthy credit habits and better protect your FICO score by always paying your bills on time and by keeping your credit balances low. This will place you in good standing with the lenders since you will be free from any liabilities.

Take control of your credit today! Call (888) 803-7889 for personalized solutions.

-