Your credit score is a crucial number that lenders use to assess your creditworthiness. A good credit score can unlock better interest rates on loans, credit cards, and even rental agreements. Conversely, a poor credit score can limit your access to credit and increase the cost of borrowing. Understanding what factors significantly impact your credit score is essential for maintaining good financial health. This article will delve into the biggest credit score killers and provide strategies to avoid these pitfalls.

Understanding the Importance of Your Credit Score

Before diving into the specific factors that can negatively impact your credit score, it's important to understand why this number matters so much. Your credit score is a three-digit number, typically ranging from 300 to 850, that reflects your credit history. Lenders use this score, along with other factors, to determine the risk of lending you money. A higher score indicates a lower risk, making you a more attractive borrower.

A good credit score can lead to:

- Lower interest rates on loans and credit cards

- Higher approval odds for loans and credit cards

- Better terms on insurance policies

- Easier approval for rental agreements

- Potentially lower utility deposits

Conversely, a low credit score can result in:

- Higher interest rates or denial of credit

- Difficulty renting an apartment

- Higher insurance premiums

- Difficulty securing employment in some industries

- Requirement of security deposits for utilities

The Major Credit Score Factors and Their Impact

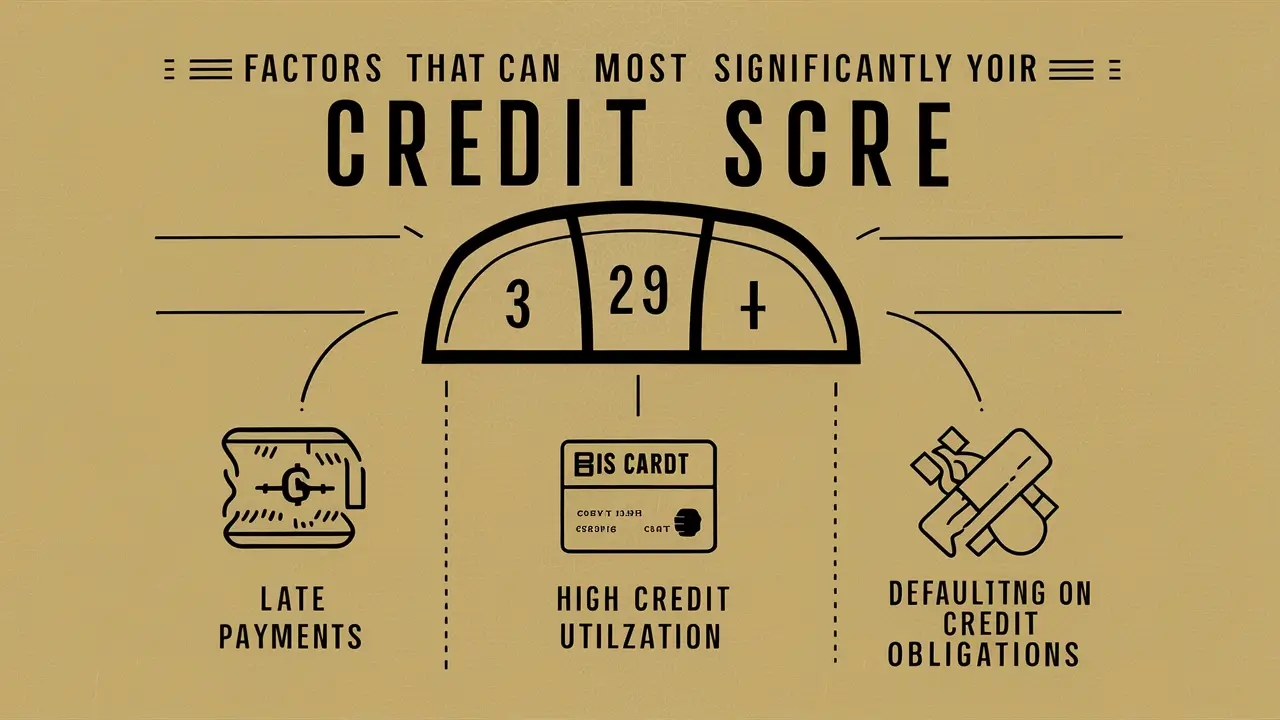

Credit scoring models, such as FICO and VantageScore, consider several factors when calculating your credit score. While the exact weighting of each factor varies slightly between models, the following are generally considered the most important:

1. Payment History (35% of FICO Score)

Your payment history is the single most important factor in determining your credit score. This factor reflects your ability to pay your bills on time and as agreed. Late payments, missed payments, and defaults can significantly damage your credit score. Even a single late payment can have a negative impact, especially if you have a limited credit history.

What Constitutes a Late Payment?

Typically, a payment is considered late if it is received more than 30 days after the due date. However, it's best to make payments before the due date to avoid any potential issues. Some creditors may report late payments to the credit bureaus even if they are only a few days late, although this is less common.

How Long Do Late Payments Stay on Your Credit Report?

Late payments can remain on your credit report for up to seven years. The impact of a late payment diminishes over time, but it can still affect your credit score, especially in the early years.

Strategies to Improve Your Payment History:

- Set up payment reminders: Use calendar alerts or automatic payment reminders to ensure you don't miss any due dates.

- Enroll in autopay: Set up automatic payments for your bills to avoid the risk of forgetting to make a payment.

- Contact your creditors: If you're struggling to make payments, contact your creditors to discuss your options. They may be willing to work with you on a payment plan or offer temporary assistance.

- Prioritize paying bills on time: Make paying your bills on time a top priority to avoid late payment penalties and damage to your credit score.

2. Amounts Owed (30% of FICO Score)

The amount of debt you owe relative to your available credit is another significant factor in determining your credit score. This is often referred to as "credit utilization." High credit utilization can indicate that you are overextended and may have difficulty managing your debt.

What is Credit Utilization?

Credit utilization is calculated by dividing the total amount of credit you are using by your total available credit. For example, if you have a credit card with a $10,000 credit limit and you have a balance of $3,000, your credit utilization is 30%.

Ideal Credit Utilization Ratio:

Experts generally recommend keeping your credit utilization below 30%. Ideally, you should aim for a utilization rate of 10% or less. High credit utilization, such as 50% or higher, can significantly lower your credit score.

Strategies to Improve Your Credit Utilization:

- Pay down your credit card balances: Reducing your credit card balances is the most effective way to lower your credit utilization.

- Increase your credit limits: Request a credit limit increase from your credit card issuers. However, avoid increasing your spending as a result.

- Open a new credit card: Opening a new credit card can increase your total available credit, which can lower your credit utilization. However, only open a new credit card if you can manage it responsibly.

- Balance transfers: Consider transferring high-interest balances to a credit card with a lower interest rate or a 0% introductory APR.

3. Length of Credit History (15% of FICO Score)

The length of your credit history is another factor that influences your credit score. A longer credit history generally indicates a more stable credit profile. Credit scoring models consider the age of your oldest credit account, the age of your newest credit account, and the average age of all your credit accounts.

How to Build a Long Credit History:

- Open a credit account early: Consider opening a credit card or a secured credit card when you are young to start building your credit history.

- Keep old accounts open: Even if you don't use a credit card regularly, consider keeping it open to maintain a longer credit history. However, be sure to use the card occasionally to prevent the issuer from closing it due to inactivity.

- Manage your credit accounts responsibly: Avoid late payments and keep your credit utilization low to demonstrate responsible credit management.

4. Credit Mix (10% of FICO Score)

Having a mix of different types of credit accounts can also positively impact your credit score. This includes a combination of installment loans (e.g., auto loans, mortgages) and revolving credit accounts (e.g., credit cards). A diverse credit mix demonstrates that you can manage different types of credit responsibly.

Why is Credit Mix Important?

Lenders want to see that you can handle different types of debt. Having a mix of credit accounts shows that you can manage both fixed payments (installment loans) and variable payments (credit cards).

Don't Open Accounts Just to Diversify

It's important to note that you shouldn't open new credit accounts solely to diversify your credit mix. Only open accounts that you need and can manage responsibly. Unnecessary debt can negatively impact your credit score.

5. New Credit (10% of FICO Score)

Opening too many new credit accounts in a short period can negatively impact your credit score. Each time you apply for credit, a "hard inquiry" is made on your credit report. Too many hard inquiries can signal to lenders that you are aggressively seeking credit, which can be a red flag.

What is a Hard Inquiry?

A hard inquiry occurs when a lender checks your credit report as part of the application process for a loan or credit card. Hard inquiries can slightly lower your credit score, especially if you have multiple inquiries in a short period.

What is a Soft Inquiry?

A soft inquiry occurs when you check your own credit report or when a lender checks your credit report for pre-approval offers. Soft inquiries do not affect your credit score.

Strategies to Manage New Credit:

- Limit the number of credit applications: Avoid applying for multiple credit cards or loans in a short period.

- Space out credit applications: Give your credit score time to recover between credit applications.

- Check for pre-approved offers: Checking for pre-approved credit card offers can give you an idea of your approval odds without impacting your credit score.

Other Factors That Can Negatively Impact Your Credit Score

While the factors discussed above are the most significant, there are other events that can negatively impact your credit score, sometimes dramatically:

Collections Accounts

If you fail to pay a debt and it is sent to a collection agency, this can have a significant negative impact on your credit score. Collection accounts can remain on your credit report for up to seven years, even if you eventually pay the debt.

How to Handle Collection Accounts:

- Check the validity of the debt: Verify that the debt is accurate and that you are legally obligated to pay it.

- Negotiate a settlement: Contact the collection agency and negotiate a settlement for less than the full amount owed.

- Request a "pay-for-delete" agreement: In some cases, you may be able to negotiate a "pay-for-delete" agreement with the collection agency, where they agree to remove the collection account from your credit report once you pay the debt. However, collection agencies are not obligated to agree to this.

Public Records (Bankruptcies, Judgments, and Tax Liens)

Public records, such as bankruptcies, judgments, and tax liens, can have a severe negative impact on your credit score. These records indicate that you have had significant financial difficulties.

Bankruptcy:

Bankruptcy is a legal process that allows you to discharge your debts. However, it can have a devastating effect on your credit score. Bankruptcies can remain on your credit report for up to 10 years, depending on the type of bankruptcy.

Judgments:

A judgment is a court order requiring you to pay a debt. Judgments can remain on your credit report for up to seven years.

Tax Liens:

A tax lien is a legal claim against your property for unpaid taxes. Tax liens can remain on your credit report for up to seven years.

Closing a Credit Card

While keeping credit cards open can help your credit utilization, closing one, especially one with a high credit limit and a long history, can negatively impact your score. It reduces your overall available credit, potentially increasing your credit utilization ratio. Before closing a card, consider its impact on your overall credit profile.

Foreclosure

Foreclosure occurs when a lender takes possession of your property due to your failure to make mortgage payments. Foreclosure can severely damage your credit score and remain on your credit report for seven years. It is often preceded by multiple missed mortgage payments, each of which would independently damage your credit.

Monitoring Your Credit Report

Regularly monitoring your credit report is essential for detecting errors, identifying potential fraud, and tracking your progress in improving your credit score. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year. You can request your free credit reports at AnnualCreditReport.com.

Consider using a credit monitoring service that alerts you to changes in your credit report. This can help you identify potential fraud or errors quickly and take action to correct them.