-

Posted on: 15 Jul 2024

-

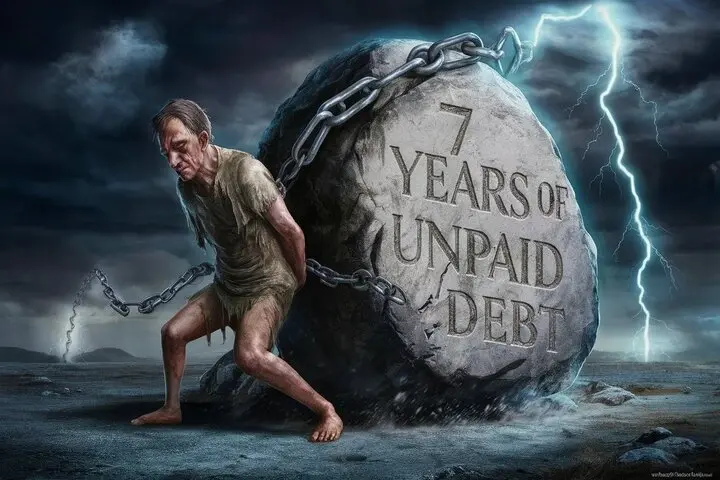

Maybe you are wondering what to do because you defaulted on a loan and have not paid the debt for the past seven years or more. Many times, people wonder whether the debt simply vanishes or evaporates into thin air. Do you have how much time to settle your matter? Seventh year Sadly it is not that straightforward. You still have to pay back the debt even if over 7 years it varies; unless the debt is bargained away or wiped out by bankruptcy.

the Statute of Limitations

Once a debt is unpaid for a predetermined period, creditors no longer have the legal authority to force debt payment. Known as the "statute of limitations," this timeframe varies depending on state and kind of debt: Known as the "statute of limitations," this term varies depending on state and type of debt:

Debt on credit cards usually takes 3–6 years to pay off.

Medical debt usually spans three to six years.

Usually acquired for a three to six-year duration, personal loans.

Auto loans are long-term loans ranging in terms of four to six years.

Usually having a contractual length of 6 to 20 years, mortgages represent the longest form of loan.

Not one of the students uses federal student loans to cover their costs.This is a legal phrase used to specify the length of time creditors might sue you to be reimbursed. Should a creditor neglect to sue within the legally mandated period, they cannot effectively return to seize your money before the courts. That does not, however, mean you are a free agent; you are not.

Of Statute Debt

Out of statutory debt is that which has been accumulated over a longer period than the permitted legal period after being seized with the aid of a legal procedure. This means that creditors no longer have legal channels of return for their money. You legally owe money even though you are not paying any now. Although creditors can still try to collect by letters, calls, etc., they cannot sue you and demand payment if you object.

Though they cannot sue you, the creditors could also assign the debt to a third-party collection agency or sell it. Mostly those in default, collection companies have the task of gathering debts from consumers. They also cannot sue you for monies outside of the statute of limitations, but they are not necessarily going to back off from aggressively attacking you.

Your Credit Transcripts

From the date of the first delinquency, delinquent lists can be filed to credit bureaus for 180 days + 7 years. The preceding is true whether the debt falls under or outside of the statute.

Outstanding unpaid collections and delinquencies can seriously lower your credit score and stay on your credit reports for several years. Late payments and collections lower scores, thereby impairing access to other loans, credit cards, mortgages, and acceptable interest rates.

Choosing Debt Relief Strategies

Unpaid debt either pending or somewhat past the statute of limitations does not imply you are without options. Two possible solutions to escape debt past seven years consist:

Negotiating a Settlement: You could try to reach a compromise with the creditor or collection agency wherein you pay less than the amount owed. This entails haggling to pay a set lesser sum of money equal to the entire former debt. The creditors are always happy to accept it when it is arranged effectively before the time elapses of the particular legislation as they want to recoup something.

Declaring bankruptcy either Chapter 7 or Chapter 13 ends the collections and also eliminates a great deal of the past debt. But bankruptcy provides the lender permission to delete your seven to ten-year credit record.

Different Ways Debt Expires

Debt may occasionally expire or disappear before the seven-year credit reporting period:

The creditor marks the debt off-meaning that he or she may decide it appropriate not to pursue the obligation or that it is not lucrative to do so. While it removes it from their financial records, "writing off" does not eliminate the debt in a traditional sense.

Should the debt arise from identity theft, it can be removed from your credit record following examination. You will have to submit a police record and proof of the misdeed for this.

Whether they are old or not, discharge in bankruptcy or paying out the whole balance is the only legal way unpaid debts can be cleared for good. Not fulfilling your responsibilities is not the same as failing to pay your debts or letting the debt vanish through the statute of limitations or by having it shown on your credit report.

Let me so underline once more that 7 years is important under the statute of limitation for unpaid debts, but this implies that the debts are not going to be ruled void. The benefits are that the debts will erase your credit profile and the creditors lose their legal ability to pursue their obligations. On the other hand, it is conceivable to owe someone for past-due debt, which, should you do nothing, could haunt you through later-date collections. On what choice would best fit your situation, it is always preferable to consult a credit counselor or legal expert.

Take the first step toward financial freedom—contact (888) 803-7889 today!