-

Posted on: 01 Aug 2024

-

FICO score is a reflection of your creditworthiness, hence it is crucial to grasp. It can range from 300 to 850; the higher your score, the less likely lenders would view you as a danger. Your score is based on information from your credit reports including credit created in the recent past, payment records, credit type, length of credit history, and credit activity.

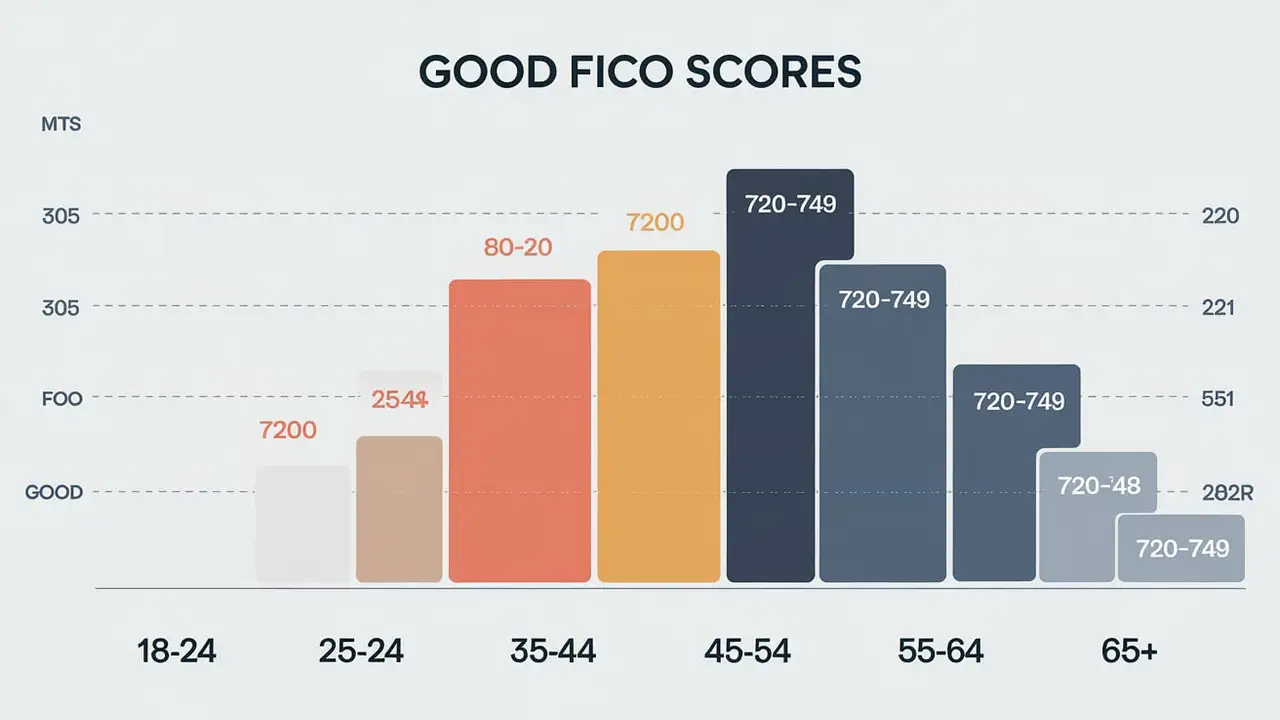

Notably, FICO does not offer specific advice on what minimal scores are regarded as "good" depending on individual age. Practices are dynamic, nevertheless; industry standards evolved. The credit scores commonly regarded as good by age category are broken out here: The credit scores often regarded as good by age category are broken out here:

18–24 years old Excellent credit score—670+ Young people who have lately begun to construct their credit history find a FICO score of 670 or above to be excellent. Although you usually have no long credit history, scoring in the upper 600s shows the lenders that you are currently using credit wisely. One should always pay bills on time, have modest credit card use, and refrain from utilizing credit that could be reasonably avoided to reach this aim.

Ages 25-34 Good credit score: 700+ Ideally, you should have a score of 700 and above by your mid to late twenties. This score range helps to tell the lenders who have followed your credit profile for a reasonable time that you have been prudent in borrowing money. If you are falling short, review your credit reports to ensure that there are no mistakes or to reduce your balances. Reduce credit application also as much as possible.

Ages 35-44 Good credit score: 740+ In the case of the thirty-something, any FICO score above 740 is considered to be good. During this stage of adulthood, you may have already borrowed money, created responsibilities, and have accumulated a long credit history over many years. This is because lenders prefer to work with those who have been using credit facilities responsibly in the long term. If you have active and positive accounts that have been opened for several years, it will be advantageous to your credit score.

Ages 45-54 Good credit score: 760+ It is important for individuals in their forties and fifties to maintain a FICO score above 760 because it is considered very good to excellent. You have had many years to prove you are a responsible borrower for credit by timely payment, not having more than 30% balance on credit cards, not frequently applying for credit or in any other way – these responsible tendencies will be reflected in high credit scores.

Ages 55+ Good credit score: 780+ If you are over 55, a range of upper 700s to low 800s is regarded as excellent. At this life stage, it may be time to retire from borrowing and start planning on how to retire when you are old. Thus, even if you employ credit infrequently, it still pays to keep a high FICO score if you will perhaps need to borrow a car, refinance a home, or get a reverse mortgage in your later years.

However, the above score ranges specified by age can give a general idea of the average score requirements for each age group of applicants to consider, as every lender has its credit score requirements for loan approval. The money you will be required to pay in interest rates and other terms for the mortgage, auto, and other loans will not only differ with the score but also with the debt-to-income ratio on the economy.

The most crucial thing to do is regularly check your credit reports as well as the FICO score from the three significant credit reporting agents. It is much better if inaccuracy is caught quickly and problems are solved at an early stage. You can build score steps and get cheap interest rates when purchasing vital necessities in life even if you are young.

Call now for expert credit repair services: (888) 803-7889

Read More:

How do I check myFICO score accurately?

How can I check myFICO score without hurting it?

Is FICO different than credit score?

Does checking FICO score hurt credit?