-

Posted on: 23 Jul 2024

-

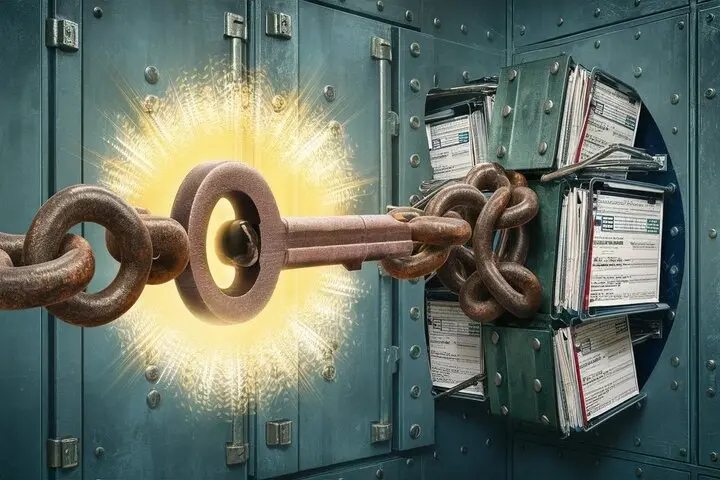

Promises of quick and simple methods to remove negative information, such as collections, from your credit report abound on the internet. These promises are sometimes accompanied by assertions of covert techniques or secret gaps. Regretfully, these assertions are either blatantly false or virtually invariably deceptive.

Legal "loopholes" exist nowhere to quickly remove accurate negative information from your credit record. Companies claiming otherwise about credit repairs are probably using dishonest methods.

How Collections Change Your Credit Score?

Let's first consider their influence before we explore appropriate approaches to managing collections:

Collections seriously lower your credit score. Lenders find them to be indicators of unstable finances.

Usually starting from the date of first delinquency, collections show on your credit report for seven years.

Obtaining loans, mortgages, or credit cards is difficult when a credit report is damaged with collections.Appropriate Approaches to Handle Collections

Although there is no magic fix, you can act early to control and maybe make your circumstances better:

1. Conflict with False Information

Review for mistakes: Go over your credit reports carefully looking for any errors.

Should you discover mistakes, dispute them with the relevant credit bureaus—Equifax, Experian, and TransUnion.2. Pay the debt—if at all possible.

Try negotiating a settlement with the collection agency, if you can afford to.

Sometimes you could be able to work out a "pay-for-delete" deal whereby the collection agency promises to delete the account upon your debt payment. This is not assured, though, hence one should exercise carefulness.3. Time and New Credit Authority

Collections will finally show up on your credit report seven years from now.

Create good credit by emphasizing building a good credit history by carefully acquiring new credit and paying on current accounts on existing ones.Avoid Credit Repair Scams.

Steer clear of upfront costs: Real credit repair businesses do not charge upfront fees.

Investigate: Before calling a credit restoration company, check the Better Business Bureau and internet reviews.

Using free tools and resources, many credit repair chores can be completed on your own.In summary

Although the concept of a credit repair loophole appeals, approach credit repair realistically and patiently. Emphasize legal tactics including debt payoff, credit history building, and dispute of mistakes. While restoring credit takes time, with regular effort and financial discipline it is doable.Call now for expert credit repair services: (888) 803-7889

Read More:

What's the best credit repair?

How do I repair my credit myself?

Can you pay someone to fix your credit score?

Can credit repair remove loans?