-

Posted on: 31 Jul 2024

-

Understanding credit scores is crucial for financial health. But what constitutes an "excellent" credit score, and does it vary depending on your age? The answer is nuanced. While credit scoring models don't directly factor in age, your age does influence the length of your credit history and potentially the types of credit products you use, which ultimately affects your score. This comprehensive guide will explore what an excellent credit score looks like at different life stages and provide actionable tips to build and maintain strong credit, regardless of your age.

Understanding Credit Scores: The Basics

Before diving into age-related expectations, let's review the fundamentals of credit scores. A credit score is a three-digit number that represents your creditworthiness. It predicts how likely you are to repay a loan or credit card debt. The higher the score, the lower the risk you pose to lenders.

Common Credit Scoring Models

The two most popular credit scoring models are:

FICO Score: Developed by Fair Isaac Corporation (FICO), this is the most widely used credit scoring model by lenders. FICO scores range from 300 to 850.

VantageScore: Created by the three major credit bureaus (Equifax, Experian, and TransUnion), VantageScore is another widely used model. VantageScore also ranges from 300 to 850.

Credit Score Ranges and What They Mean

While slight variations exist between FICO and VantageScore, here's a general breakdown of credit score ranges:

Exceptional/Excellent (800-850): This range signals low credit risk and qualifies you for the best interest rates and loan terms.

Very Good (740-799): Still a strong credit score that allows you to access favorable terms and rates.

Good (670-739): Considered an average credit score. You'll likely be approved for loans and credit cards, but you might not receive the best interest rates.

Fair (580-669): Indicates a higher credit risk. You may face higher interest rates or difficulty getting approved for credit.

Poor (300-579): Represents significant credit risk. Getting approved for credit can be challenging, and interest rates will be very high.

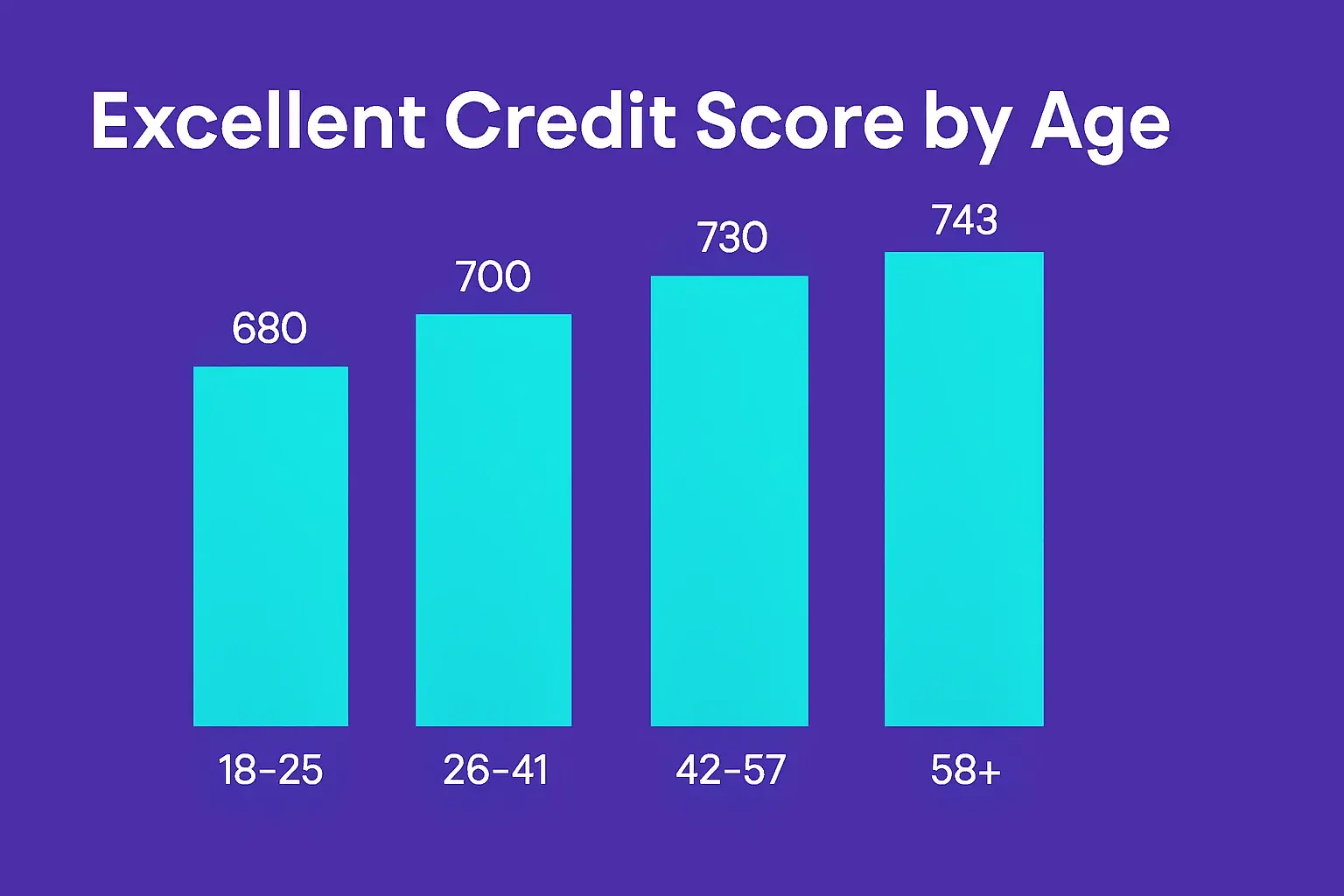

Credit Score Expectations by Age Group

While there's no explicit "ideal" credit score for each age, here's how age generally influences credit score averages and expectations:

Young Adults (18-24): Building Credit from Scratch

This age group is often just starting to build credit. Many haven't had the opportunity to establish a long credit history. Therefore, having *any* credit score is a positive sign. The focus should be on building a positive credit history, not necessarily achieving an "excellent" score right away. A score in the "Fair" or "Good" range (630-700) is a reasonable goal during this phase. Remember that it takes time to establish a solid credit profile.

Strategies for Young Adults:

Become an Authorized User: Ask a parent or trusted adult with good credit to add you as an authorized user on their credit card. This allows you to benefit from their positive credit history.

Apply for a Secured Credit Card: Secured credit cards require a cash deposit as collateral, making them easier to obtain for individuals with limited or no credit history. Use the card responsibly and pay your bills on time.

Student Loans: If you have student loans, make sure to make on-time payments. Student loan payments are reported to credit bureaus and can help build your credit.

Avoid Overspending: Don't rack up debt that you can't repay. Start small and gradually increase your credit usage as you become more comfortable.

Young Professionals (25-34): Establishing a Strong Credit Foundation

By this age, individuals typically have had more time to build their credit history. They may have mortgages, auto loans, or other credit accounts. A "Good" to "Very Good" score (670-779) is a realistic target. This range opens up opportunities for better interest rates on larger purchases like homes and cars.

Strategies for Young Professionals:

Diversify Credit: Having a mix of credit accounts (e.g., credit cards, installment loans) can positively impact your credit score.

Monitor Your Credit Report: Check your credit report regularly (at least annually) for errors or fraudulent activity. You can obtain free credit reports from AnnualCreditReport.com.

Pay Down Debt: Prioritize paying down high-interest debt, such as credit card balances. Lowering your credit utilization ratio (the amount of credit you're using compared to your total available credit) can significantly boost your score.

Avoid Applying for Too Much Credit at Once: Multiple credit inquiries in a short period can lower your score.

Mid-Career (35-44): Maximizing Credit Potential

Individuals in this age group have usually had ample time to build a substantial credit history. An "Excellent" score (800+) is achievable and should be a long-term goal. Maintaining a high credit score in this range provides access to the best financial opportunities and rewards.

Strategies for Mid-Career Individuals:

Maintain Low Credit Utilization: Aim to keep your credit utilization ratio below 30% (ideally below 10%).

Pay Bills On Time, Every Time: Payment history is the most important factor in your credit score.

Review Credit Reports Regularly: Continue to monitor your credit reports for accuracy.

Consider Credit Card Rewards Programs: If you're responsible with credit, take advantage of credit card rewards programs that offer cashback, travel points, or other benefits.

Late Career (45-64): Maintaining Excellent Credit

At this stage, maintaining an "Excellent" credit score (800+) is key for retirement planning and securing favorable financial terms. This age group often has significant assets and wants to ensure they can access them easily and affordably.

Strategies for Late-Career Individuals:

Protect Your Credit from Fraud: Be vigilant about protecting your credit from identity theft and scams.

Avoid Closing Old Credit Accounts: Closing old credit accounts can reduce your overall available credit and potentially negatively impact your credit utilization ratio.

Continue to Monitor Credit Health: Even with a strong credit history, it's essential to continue monitoring your credit reports and scores.

Plan for Large Purchases: If you're planning a large purchase, such as a vacation home, ensure your credit is in excellent shape to secure the best mortgage rates.

Seniors (65+): Preserving Financial Security

For seniors, maintaining a good credit score (670+) is important, even if they are not actively seeking new credit. It can impact insurance rates, security deposits, and other financial aspects of life. Focusing on preserving existing credit is key.

Strategies for Seniors:

Automate Bill Payments: To avoid missed payments, set up automated bill payments.

Be Wary of Scams: Seniors are often targeted by scammers. Be cautious of unsolicited offers or requests for personal information.

Review Credit Regularly with a Trusted Family Member: Consider having a trusted family member help monitor your credit report for any suspicious activity.

Maintain a Solid Financial Foundation: Focus on managing existing assets and avoiding unnecessary debt.

Factors That Influence Your Credit Score

Understanding the factors that influence your credit score is crucial for building and maintaining good credit, regardless of your age. These factors are generally weighted as follows by FICO:

Payment History (35%): This is the most important factor. Paying your bills on time, every time, is crucial.

Amounts Owed (30%): This includes your credit utilization ratio, which is the amount of credit you're using compared to your total available credit.

Length of Credit History (15%): A longer credit history generally results in a higher credit score. This is why age *indirectly* plays a role.

Credit Mix (10%): Having a mix of credit accounts (e.g., credit cards, installment loans) can positively impact your score.

New Credit (10%): Opening too many new credit accounts in a short period can lower your score.

Debunking Credit Score Myths

Several common misconceptions surround credit scores. Here are a few myths debunked:

Myth: Checking your credit score lowers your score. Fact: Checking your own credit score (using a service like Credit Karma or through your bank) is considered a "soft inquiry" and does not affect your score.

Myth: Closing unused credit cards helps your score. Fact: Closing unused credit cards can lower your score, especially if it reduces your overall available credit and increases your credit utilization ratio.

Myth: You only need a good credit score when applying for loans. Fact: A good credit score can benefit you in many ways, including lower insurance premiums, easier rental applications, and better cell phone plans.