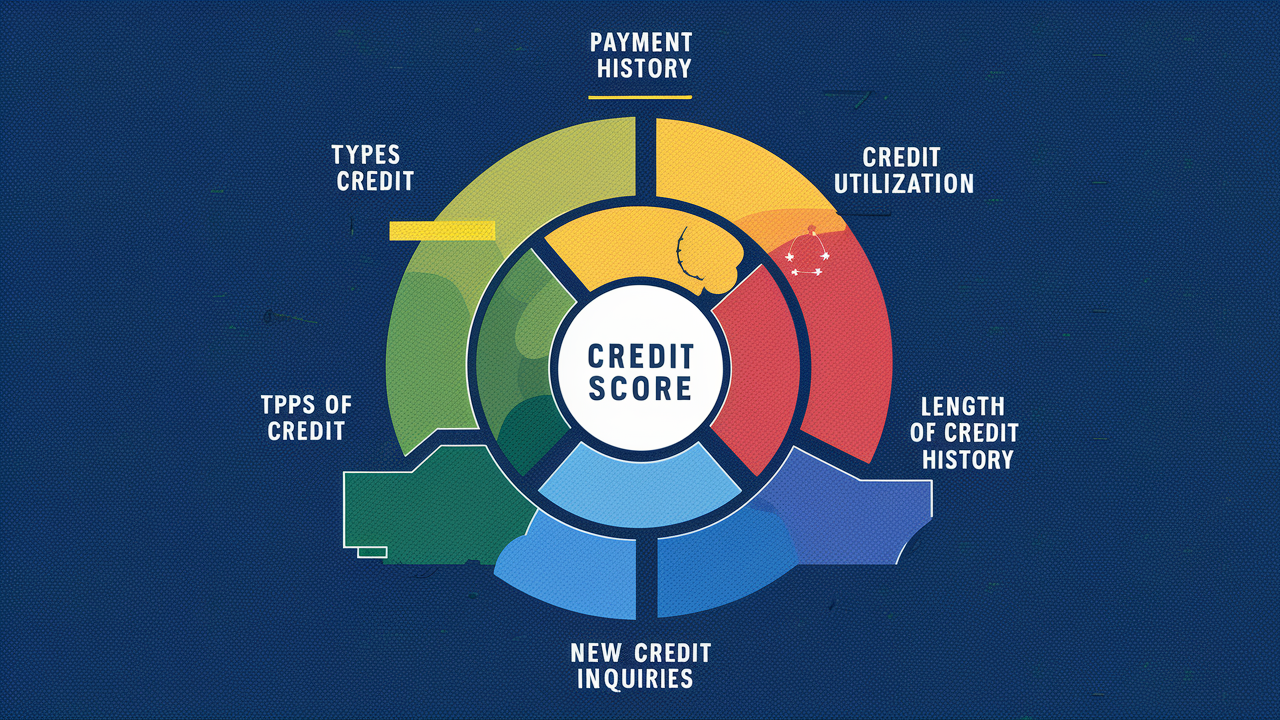

There is nothing in your financial life that can be more important than your credit score. It affects the decisions about credit as well as when you can qualify for credit cards, loans, and even the interest rates. But what’s on the top of the list when it comes to credit scoring and determining one’s score?

Payment History

Late payments or missed payments are the most influential aspect that affects the score of an individual. This aspect on its own is worth 35% of your FICO credit score, which is the score that more than 90% of creditors use.

Your payment history examines whether you made payments on your credit accounts such as credit cards, auto loans, student loans, and mortgages- on time over the month. A single late payment can have a bearing on your score though it is better compared to when you do not pay at all. Second, any lateness is punished, and the degree of punishment increases – the later the return is, as well as the more recent it is. For instance, missing a credit card payment in the last year is a significant negative than if one was 30 days behind on the same card over three years ago.

The way to deal with this factor is, to the extent possible, never to be late on any payment. Designate that your loan payment or regular transfers shall be automatic so that you do not forget and hence miss those payments. If you cannot afford the payments, then it is wise to talk with the credit companies you intend to default to before going for hardship programs or lower payments. If at all, the aim is to ensure that nothing is reported as being late to the credit bureaus.

Amounts Owed

The second largest component is the level of debt you carry, which contributes 30 percent to your credit score. This particularly pays attention to the portion of the revolving credit that you are using relative to your total available credit including credit card and home equity credit lines.

Ideally, the percentage that has to be achieved is below thirty because that is the threshold most credit card issuers look for. The idea of employing more of the available balances is regarded as being risky. It becomes more dangerous to loan money to someone who has reached his limit on all his cards than to someone who charges a very small percentage of his credit.

To manage this, do not use cards to make purchases that you cannot afford to settle when the billing cycle comes around. You may also consider negotiating for higher credit limits from your issuers so that your utilization percentages go low. You just have to watch out for the higher limits so that you will not overspend and get into the red.

Length of Credit History

In the third position, we have a length of credit history with 15 percentage points contributing to the overall credit score. This is a measure of the average age of your credit accounts, that is, how long you have been using your credit accounts. If one has a proven record of timely payments and ample credit history, he or she is considered a low-risk candidate.

There is no ‘magic’ solution here as time is the primary issue that needs to be resolved. That old credit card and installment loan accounts can help. Avoid the mistake of closing other unused cards since this move can negatively impact this factor, especially when you close old accounts.

A mix of Credit Types

Credit mix takes up to 10 percent of your score based on the types of credits that you have. Like with all loans, credit card lenders prefer candidates with prior experience in the management of various types of credit – credit cards, retail accounts, installment loans, and even mortgages. Both credit cards and an auto or student loan can show you have diversity over merely utilizing credit cards.

The best way to also address this factor is to open several credit accounts you can handle efficiently to help build it up. Just ensure that you avoid opening many new accounts all at once since this can cause the score to lessen for a while.

Consequently, how you have paid them in the past is the largest aspect of your credit score as you can see. Other factors include avoiding balances to remain low, having different types of credit, and letting history expand in terms of time. All those who will follow these tips will witness an improvement in their credit score in the long run.

Call now for expert credit repair services: (888) 803-7889

Read More:

Can I be chased for a 10-year-old debt?

How long before a debt is uncollectible?

What is the lowest credit score to buy a car?

How much is a mortgage payment on a 200k house?

What is the only proven way to improve your credit score?