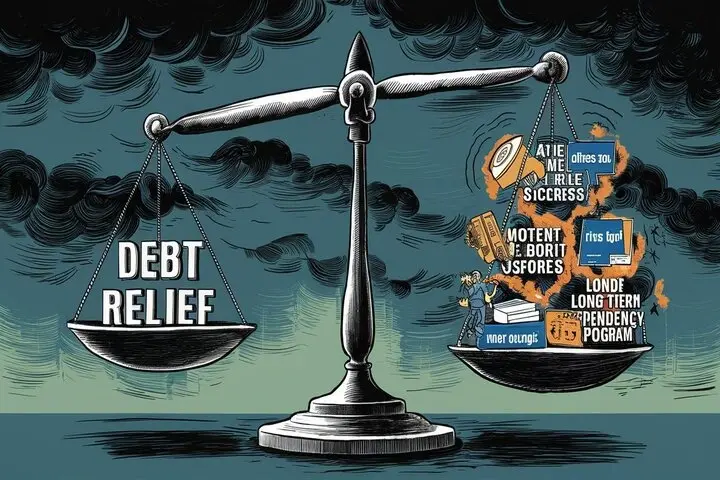

Debt relief may appear like the nicest thing that could happen to you whenever you find it difficult to pay or see unworkable amounts of debt. Debt settlement or consolidation, debt consolidation loans, credit counseling, bankruptcy — they all promise the lure of a debt-free future.

Like any type of debt relief, each of these several approaches has certain possible risks and drawbacks. Deciding whether or not debt reduction is the best line of action for you would then be far simpler.

The Risk of Dedicating Yourself to Payback Debt for Less

Your goal in debt settlement is to bargain with creditors and lower the amount you will need to pay back. This will most definitely help to reduce the cost of debt. This argument does have certain limits, though, which should be noted.

First of all, it could not be feasible to apply this form of debt management plan as there is no guarantee that your creditors will consent to accept the settlement sum for the whole amount owing. Should they choose to sue and settle, they are unlikely to pay you the entire sum but rather only a fraction, say 40–60%.

For many, this would still seem to be a fantastic deal. But you have to weigh the hazards, like However, you have to weigh the hazards, such as:

Given the income tax, there could be a tax due on the amount of the loan canceled. It will also damage your credit score and the negative notes that can show up on your credit records for seven years.

You will also lose several rights that those who are paying back debt as agreed upon enjoy.

She said: - That means even if you spotted the creditors coming and managed to pay them back before they change their mind as the limitation period closes, any savings you have can still be confiscated in a lawsuit.

To sum up, as you could have observed, paying off debt for less than the whole amount offers benefits and drawbacks. This is an aggressive strategy for debt alleviation; hence, before using it, you should make sure you use critical thinking in your circumstances.

Con: How Debt Consolidation May Backfire

One clean answer could be financing to pay off other debt using debt consolidation loans or balance transfer credit cards. To be advantageous over time, one new loan is to be sought to pay off numerous others under a reduced interest rate. This approach can, however, turn useless.

This is true because debt consolidation loans could cause the payment period for the money you owe to lengthen and cause extra interest on the total amount to be accumulated. Alternatively, one can only move between the high-interest credit card balances without paying off with the use of a balance transfer credit card.

Another effect is that after consolidation you could find yourself back in the high balances on your previous credit cards or develop new credit card debt. Paying the face value of existing debts together with some fresh debt to control places you in an even worse state than before this slipper slide!

Credit Counseling: Use Care and Review the Fine Print

Nonprofit credit counseling companies claim their debt management strategies are more successful than bankruptcy. They approach your creditors asking for flexible loan terms based on your capacity to pay through reduced rates or installment amounts. Unlike merging the debts into one large loan, this helps one pay the amount over some period.

Give careful thought to handing a credit counseling firm complete control over your financial situation. Initially, most of the accounts you list in a debt management plan hurt your credit reports and scores. Many of the agencies also charge monthly fees to help oversee the plans. Furthermore, although the approved payment plans are set in stone, neglect of this could result in program dismissal with significant fines.

Results of Declaring Bankruptcy Declaring bankruptcy does, however, have some benefits as well as drawbacks.

Filing for Chapter 7 or Chapter 13 bankruptcy will immediately stop collection activities and can help some debt be discharged. At times, this can be rejuvenating.

Still, this greatly influences your finances for years once you file for bankruptcy. Your credit score will have decreased noticeably since the bankruptcy will stay on your credit report for up to seven to ten years. It makes applying for cards, credits, loans, insurance, or a job considerably more difficult and expensive.

In bankruptcy, you also usually have to give up certain assets—like a second car or a vacation property. Not all debts can be eliminated; for instance, through bankruptcy, civil or student loans, less than three-year-old taxes, alimony, and child support payments. For many people, on balance, it is not worth it to become bankrupt.

Conclusion

All things considered, one should treat debt relief with great prudence before starting a certain path of action. Not only are the risks and drawbacks found in the written accounts of them. The downsides include damaging a debtor's credit situation and ending in a worse financial situation than before, while debt collectors just ask for debt repayments ignoring their effect on a debtor.

Spend a lot of time investigating, considering the consequences, and assessing all the options to help you avoid being under pressure to make a decision you could come to wish for. It could be better to concentrate on your debt issues in a more efficient approach by thinking about strategies for avoiding debt buildup, lowering expenditure, or contacting creditors to negotiate better conditions. Therefore, depending just on debt relief is not always recommended as the solution for the debt issues.

Call now for expert credit repair services: (888) 803-7889

Read More:

How to stop paying with credit cards legally?

How can I wipe out my credit card debt?

How to pay off credit card debt when you have no money?

Can you walk away from credit card debt?