-

Posted on: 05 Aug 2024

-

One of the best-known credit scores applied in the United States of America is the FICO score. According to statistics, around ninety percent of the biggest lenders base creditworthiness on FICO scores. FICO scores fall in the 300 to 850 range. As the computed score rises, credit risk falls; so, the credit risk is lower the higher the score. But average FICO scores are what? Alright, let me dissect this.

The Most Common FICO Score Most authorities agree that a FICO score between 670 to 739 is either average range. FICO regards scores in this range as good. This indicates that the person has a modest credit risk, so the risk that lenders are ready to accept is under control. As Experian, one of the three credit bureaus notes, other credit reporting companies discovered that the average FICO score in 2022 is 716. This represents more on the upper side of what would be regarded as a regular or average credit score.

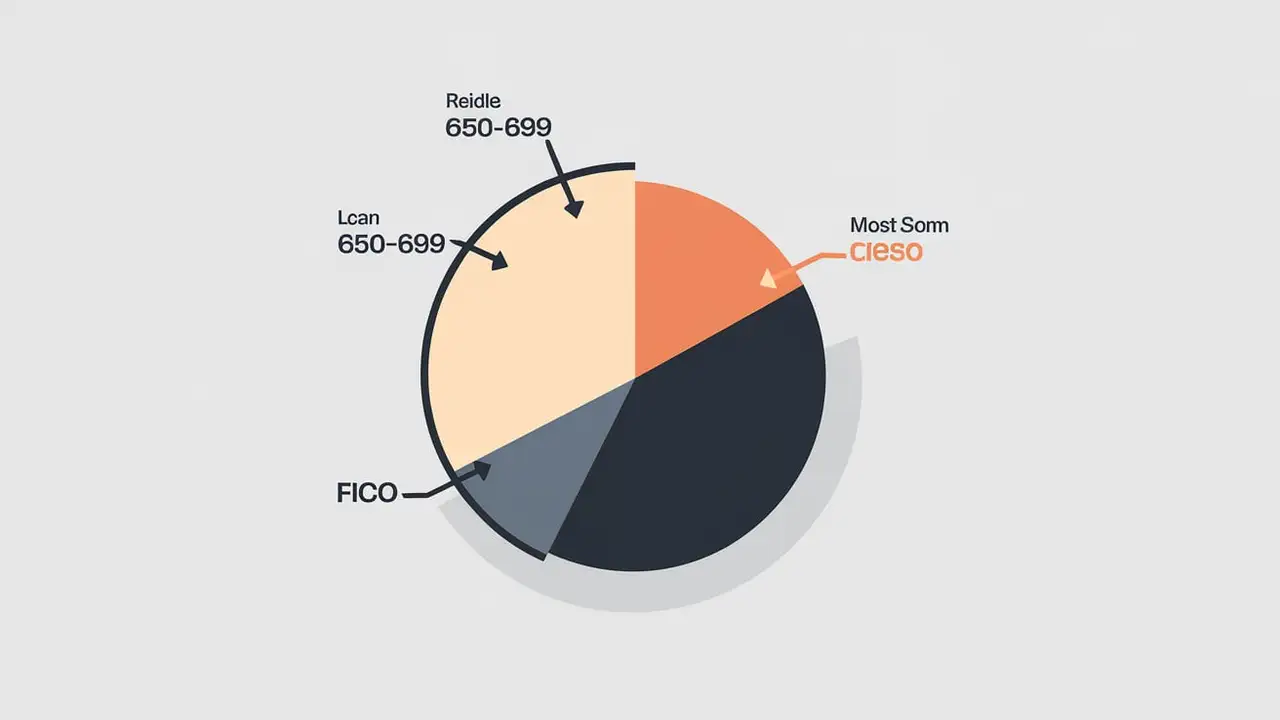

Consumers with FICO scores ranging from 670 to 739 are 28 percent. This makes it the largest percentage of consumers within a score range. The next largest percentage is about 24%, which is a fair credit rating that ranges from 580 to 669. Out of the whole population, only 5% have exceptional FICO scores that range above 800.

Why People Consider a Score of 700 As Average A FICO score of about 700 is considered an average or a regular score because of the way the FICO score works. The FICO model is aimed at presenting the risk on a scale ranging from 300 to 850 so that consumers’ scores are within the range of 620-785 percent of the time. As 700 is in the middle of this range, it means that the credit risk that is associated with this score is considered average.

The FICO is constantly reviewed and upgraded over time to reflect changes in economic cycles and the market. However, the relative frequency is still dominated by the fact that 68% of consumers are located in the range of scores from 620 to 785. According to this distribution, lenders have taken to considering 700 as the mean credit score of a population, meaning that it is average.

It also helps explain why getting a 700 FICO is considered the benchmark to get better rates and terms on credit. This implies that if you have an average score, lenders consider that you have acceptable default risk to enable them to offer financing at lower costs.

Key Credit Score Ranges While 700 represents an average score, it can be helpful to understand the benchmark credit score ranges according to Experian:

800-850: Exceptional 740-799: Very Good 670-739: Good 580-669: Fair Below 580: Very Poor

Exceptional and Very Good scores often fall into the best loan products such as low interest rates and higher credit limits. Average and Fair scores may qualify, but there might be extra conditions that a customer will have to meet. People in the Poor category either do not qualify for a loan or qualify for a loan with high interest rates.

Thus, when it comes to this effective average FICO score, it is better to aim even higher, for instance, at about 700+. A score of more than 760 ensures that you get the best rate when you need credit. The lowest rates are offered to customers with Very Good and Exceptional credit ratings.

The following factors can influence your credit score: Various aspects are considered in the determination of a FICO credit score. However, FICO scoring models are heavily weighted towards these major factors: However, FICO scoring models are heavily weighted towards these major factors:

Payment History (35%): It is thus clear that having no late payments leads to better scoring. Amounts Owed (30%): Holding lower balances as a percentage of credit limit is helpful to a score. Length of Credit (15%): That is advantageous if one has built up good credit over the years. New Credit (10%): A small number of new applications or inquiries assists. Credit Mix (10%): Management experience of various types of credit is useful.

Building good credit habits ensures as many aspects as possible are optimized to ensure the FICO is high in the long run. Bad credit decisions may lead to a good credit score decreasing by 100 points or more based on the degree of the problem.

Consumers in the higher income bracket also tend to have higher average FICO scores because consumers who require more credit and can responsibly manage larger lines are more likely to be in this group. However, one does not have to make a lot of money to get an average 700 score when paying attention to credit.

Improving Your Credit Score If your current FICO falls below that average score range, there are steps you can take to improve it: If your current FICO falls below that average score range, there are steps you can take to improve it:

-Check credit reports and correct them if necessary. There are implications that mistakes are not favorable for a score. -Make all credit accounts on time that is all credit accounts should be paid on time in the future. Late payments significantly harm rankings as well as credit history. -It's possible to bring any existing past-due accounts up to date. -Credit utilization should not be very high compared to the limit set on credit cards. High utilization hurts. -It is advised to not open any new credit that is not essential until the score has been raised. More hard inquiries will affect it for the next year. -They should also consider a positive credit history by being added as an authorized user on someone else’s open account if the main account holder has a good payment record and low credit utilization. -Spend within your means and only borrow money that could easily be repaid based on one’s income.

Again, with the proper exercise of credit management, a good FICO score can be built over some time. The majority of negative information is reported on credit reports for 7 years. While that information depreciates and falls off in addition to acquiring a positive payment history, the score can bounce back and even go over 700.

The effect of late payments, collections, and other derogatory information decrease as more positive history is established. Thus, after 7 years, the old negative history is out of the picture entirely excluding cases when new problems appear. This allows your score to gradually increase over time.

To maintain good credit, one must ensure the following: Aim for an average FICO score is a great starting point for attaining and sustaining a healthy credit score in the long run. An average of 700 FICO or higher speaks about responsible usage in comparison to tens of millions of other consumers. It makes the business eligible for low interest charges from the lenders and this is cheaper in the long run in terms of costs of funds.

The credit tiers above 700 which include exceptional and very good offer even more advantages. However, a median or average of 700 FICO score remains fairly achievable for most people, as long as they practice good credit habits and monitor the utilization of credit across their credit file credit products. The monthly score control will enable you to track your progress.

Call now for expert credit repair services: (888) 803-7889

Read More:

How do I get my real FICO Score?

What number is a perfect FICO Score?

What is the best site to check your FICO Score?

Can I check myFICO score without penalty?