-

Posted on: 05 Aug 2024

-

One of the most important figures defining your financial activity is your FICO score. Lenders most often use this number to decide if you qualify for credit cards, mortgages, loans, and so on. While a negative FICO score may indicate that the borrower needs to pay more for a loan or even could be refused credit, a strong FICO score can translate into more advantageous interest rates.

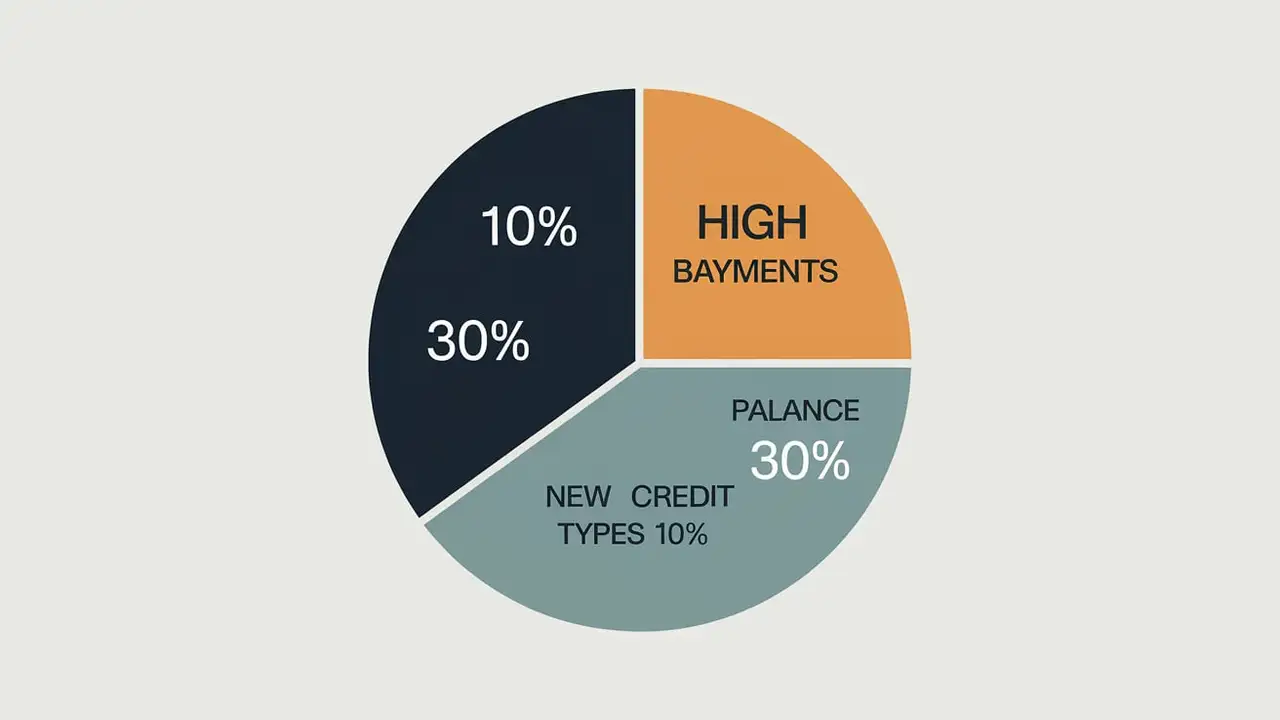

Payment histories, amounts owed, credit history duration, credit mix, and inquiries are the five main elements influencing your FICO score. Some activities in every one of these areas might lower your score. Understanding these FICO score killers can help one avoid them and consequently result in a higher FICO score.

Payback History With 35 percent of your FICO score based on your ability to pay your obligations on time, credit history is most important about this ability. Paying history helps one determine if the borrower has been making monthly payments to his lenders and creditors. Even a one-point loss occurs after 30 days of late bill payment; the effect increases with more recent and frequent missed payments. Among the things that could reduce your FICO score are Lowering your FICO score might come from:

- Paying bills late will show on your credit report; late payments on many accounts can lower your score. 30, 60, or 90 days late will be noted.

- One of the worst things to happen is defaulting on a credit account and having the collections agency take over; your score can drop 100 points or more.

- Declaring your inability to pay your bills for as many years as you might like is made feasible by bankruptcy. The credit record shows

- Chapter 13 bankruptcy for seven years whereas Chapter 7 bankruptcy for ten years.

- Foreclosure/Repossession: The largest indicators to potential lenders that lower your score are any acts related to having property foreclosed or things repossessed.

Credit Utilization More specifically, credit utilization is the second most important factor for FICO scores and accounts for 30 percent of your score. Having maxed-out cards and high balances close to the credit limit indicate risk. Things that reduce your score include: Things that reduce your score include:

- High balances: Having credit card utilization more than 30 percent of your total credit limit reduces your score. Minimize the individual and total use.

- Maxing out cards: Maxing out several credit cards hurts your score because this consumes 100 percent of the credit limit of the cards.

- Rising balances: An increasing debt load is a sign of risk, and it brings a decrease in FICO score. It is recommended to pay off the cards with the highest balances.

Credit History Length Ideally, the longer the credit history the better. This factor constitutes 15% of the FICO score and determines the oldest credit account, newest credit account, and average account age. You can’t speed up time, but things that shorten your history include: You can’t speed up time, but things that shorten your history include:

- Closing old, paid accounts: Your oldest account, the one you have kept open the longest, influences this factor most, and therefore, you should not close your oldest cards.

- Opening many new accounts: The younger your newest account is, the more it will bring down your score until it becomes older. Space out applications.

- Average age under 3-5 years: Unfortunately, with few or newer accounts, it may take years to develop history. About 5 or more years of history are preferred in many scoring models.

Credit Mix Credit utilization and credit mix contribute to 10 percent of the FICO score. It looks at your types of open credit—credit cards, retail store cards, installment loans, mortgages, auto loans, student loans, etc. Relying too much on one type lowers your score: It looks at your types of open credit—credit cards, retail store cards, installment loans, mortgages, auto loans, student loans, etc. Relying too much on one type lowers your score:

- Only having credit cards: This implies that consumers who only have credit card records on their credit reports will be given lower scores than those with different kinds of credit accounts.

- Many department store cards: Having several credit card accounts from retailers decreases the credit mix because accounts from retailers usually offer worse terms.

- No mortgage/auto loans: Mortgages and car loans, which are installment loans, demonstrate that you understand the various forms of credit and steady obligations over multiple years.

Credit Inquiries Credit inquiries for new credit accounts for 10% of the FICO score. If you apply for credit, the report is accessed and the process results in a hard inquiry by the lender. Too many in a short timeframe signal credit hunger and weigh down your score: Too many in a short timeframe signal credit hunger and weigh down your score:

- Applying often for new credit: When you apply for several credit cards at a time or get rejected severally, several hard inquiries will build up and pull down your score for some time.

- Rate shopping mortgages/student loans: When done within a short period, checking your rate across multiple lenders is only considered as one inquiry – but other forms of shotgun shopping are harmful.

- Letting others check your report: However, even soft inquiry conducted by insurers or landlords could have a slight effect nonetheless, if conducted too frequently. Minimize access.

How to Rebuild Credit Score After It Was Harm If you have seen your credit score drop because of some late payments, collections accounts, or any other negative remarks you don’t need to despair because your credit score is not a permanent thing. The majority of the negative remarks last for not more than seven years before they disappear from your credit report. You can also offset them: You can also offset them:

- Improve utilization: Balances should be kept way below 30 percent of the credit limits and then your credit score will improve with time. Minimize revolving credit and try to bring down as much as possible the balances that are charged on cards.

- Ask for a goodwill fix: It is possible to negotiate with the lenders for the late payments to be removed if you talk to them and have no other bad records with them.

- Dispute any errors: If you find out that there is something adverse to you on your credit report, you should file a dispute and prove that it is a mistake.

You should be careful to check credit reports and FICO scores regularly to correct emerging problems and avoid recurring mistakes. This means that if you are willing to dedicate time and practice good financial behaviors, you can increase your credit score by 100 points or even more.

Call now for expert credit repair services: (888) 803-7889

Read More:

How do I get my real FICO Score?

What number is a perfect FICO Score?

What is the best site to check your FICO Score?

Can I check myFICO score without penalty?

- Paying bills late will show on your credit report; late payments on many accounts can lower your score. 30, 60, or 90 days late will be noted.