How to freeze your credit ?

What is a credit freeze?

A credit freeze is a security measure that lets you lock down your credit files to prevent identity thieves from opening new accounts in your name.

A credit freeze prevents creditors (including lenders, landlords, and employers) from accessing your credit report without your permission. It also prevents new loans, utility services, and cell phone service providers from opening an account in your name without checking with you first.

There is a fee for placing or removing a freeze on your account. Placing a freeze on all three major consumer reporting agencies can cost up to $30 per person (or $90 for a family).

How to freeze your credit ?

Identity theft is a serious issue that affects more and more people. If you have been the victim of an ID theft, then it's important to protect yourself with credit freezes--a security measure which restricts access your file so no one but yourself can see what information there might be on them!

If you are worried about being targeted, consider putting credit freezes on your accounts to protect yourself from this kind of fraud! You can get all the information in this guide so that it will help make up for any slower access times when using them as well-but remember: not everyone needs such protection right away - only take action if needed because there's never too early or late enough...

When should I freeze my credit?

Credit freezes are not a new phenomenon. They have been around since the 1970s, but they only became more popular after the Equifax breach in 2017.

Credit freezes are also referred to as security freezes. They allow you to block access to your credit report, which means that no one can open a new account in your name or take out a loan in your name without your express permission.

This is a good way for consumers to protect themselves from identity theft and fraud, but it does come with some drawbacks.

Does a credit freeze protect me from all identity theft?

A credit freeze does not protect you from all types of identity theft. It can be bypassed if the thief has your personal information and is willing to pay the fee.

Credit freezes do not protect you from identity theft that happens when someone steals your personal information and uses it to open a new line of credit in your name. Credit freezes also don't protect you against identity theft that happens when someone steals your Social Security number, driver's license number, or other identifying information and uses it to open a new line of credit in your name.

How to place Freeze on Credit ?

A credit freeze prevents lenders from accessing your credit report. This makes it more difficult for identity thieves to open new accounts in your name.

A credit freeze does not affect your ability to use existing lines of credit, such as a home or car loan, or to apply for new lines of credit.

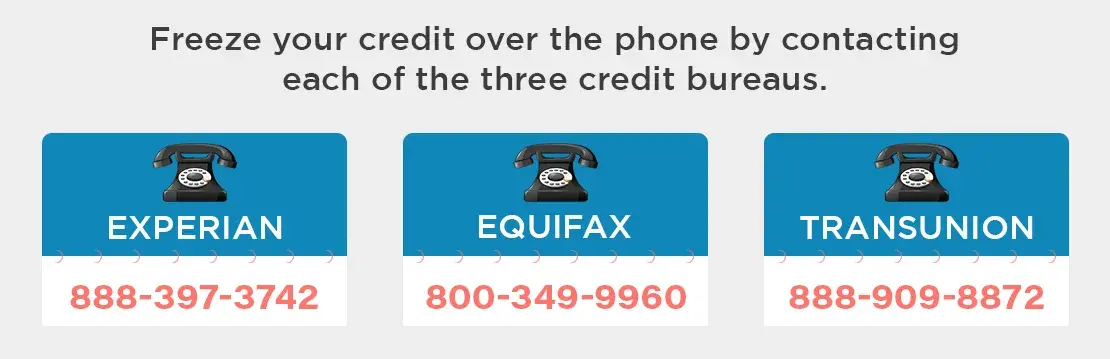

In order to request a credit freeze, you will need to contact each of the three major consumer reporting agencies: Equifax, Experian and TransUnion.

How long is a credit freeze good for?

A credit freeze is a security feature that can be activated in order to prevent thieves from opening new lines of credit in your name.

A credit freeze will not affect your ability to use the existing lines of credit that you have, such as a checking account or a car loan. However, it could impact your ability to open new lines of credit, like an apartment rental or cellphone plan.

A credit freeze is good for up to 7 years and it costs $10 per person per agency request.

How to Freeze my Credit Report?

It is essential to freeze your credit report to safeguard your financial and personal identity. It helps you to save your data and you can avoid fraud. Reach out to Equifax, Experian, and TransUnion, the three major credit reporting agencies in the USA. You may submit your freeze request by letter, phone, or the Internet. It will be important to have your address and Social Security number, among other personal details. Once the suspension takes place, it restricts your ability to see your credit report and prevents new accounts from being opened in your name, which increases the difficulty of identity theft. If a credit application is required, the moratorium could be waived in the short term.

How do I unfreeze my credit?

A credit freeze is a security measure that prevents lenders from accessing your credit file. This will make it impossible for someone to open a new account in your name, because they won't be able to access your credit report.

This is an effective measure against identity theft and fraud. It also provides protection if you're planning on applying for a loan or credit card in the near future.

The process of unfreezing your credit can vary depending on the state where you live. In some states, you'll need to contact each of the three major bureaus individually and ask them to remove the freeze on your account before you can apply for new lines of credit.

How much does a credit freeze cost?

A credit freeze is a tool that allows consumers to prevent potential creditors from accessing their credit report. This is a good way to protect your credit score while you are looking for a new job and are not sure if you will be able to keep up with payments.

A credit freeze can cost anywhere between $5 and $10, but it varies depending on the state in which you live. Some states offer free freezes for their residents, while others charge up to $30 for the same service.

What are the pros and cons to a credit freeze?

A credit freeze can be an effective in helping keep your identity safe, but there are some downsides. Here are some of the main pros and cons:

Pros:

- It helps protect you from identity theft

- Activities with your current credit accounts, like asking for a higher credit limit, are still allowed

- Unfreezing is now legally required to happen in less than an hour

Cons:

- It takes extra steps for you to give access for a credit check

- A PIN must be memorized and kept safe in order to unfreeze your account

- Each credit bureau must be contacted for the freeze to be most effective

Does a credit freeze affect my credit score?

A credit freeze prevents new creditors from accessing your credit report. The process of freezing your credit will not affect your credit score because it doesn't involve a change in the information that is reported to the three major credit bureaus.

A credit freeze can help you prevent identity theft and fraud by making it difficult for thieves to open new accounts in your name.

A security freeze is typically free, but you may be charged a fee if you want to temporarily lift or remove the freeze on your report.

What are the alternatives to a credit freeze?

Credit freezes are one of the most popular ways to protect your credit. It stops thieves from opening up new credit cards in your name.

There are other alternatives to a credit freeze that you can use to protect your credit. One of them is a fraud alert which alerts creditors that you want more time to review any new account. Another option is a credit lock which prevents anyone from opening up any new accounts in your name.